The priciest thing you can buy in Singapore is probably your home. Even if you don’t mind a rugged aesthetic, minimalistic, or industrial look, basic renovation is still necessary for installation of electrical endpoints, tilework, paintwork, and so on.

If you’ve done the maths, you’ll realise that renovations can cost an arm and leg. However, did you know that you can take a personal loan in Singapore to help finance your renovation? Another option is taking a renovation loan, but what’s the difference between the two?

Before we go into that, let’s first look at how much home renovation can cost in Singapore.

How Much Can Home Renovation Cost In Singapore?

A ballpark figure for a typical HDB renovation in Singapore costs S$53,000. Depending on a number of factors, renovation costs for a 4-room HDB flat can range from as low as S$4,888, to as high as S$110,000.

Here are some major factors that can affect the cost of your home renovation:

- Type of home: Is your home a HDB flat, EC/condo, or landed house?

- Age and condition of your home: The extent of renovation work for a brand new fully-furnished condominium can differ greatly from that of an aging resale flat.

- Extent of your renovation: Do you plan to make minor enhancements, or are you looking to start from a blank slate such as by hacking down walls?

- Type of materials to be used for the renovation: If you have expensive taste and want flooring materials like granite or marble, be prepared to fork out more.

- The contractor/interior design firm you pick: Different firms offer different rates. Make sure to do your research and ask questions!

Of course, whether you’re a new or existing homeowner, you don’t always have to go all out with your renovation on the first round. If you’re short on funds, you could carry out your renovation in stages—progressively getting done over a span of time as you save up more money.

Learn more about how you can lower your renovation costs here.

However, if that’s not an option you’d like to consider, you can take out a loan to meet your renovation financing needs.

Let’s take a look at how personal loans and renovation loans differ in this respect.

What’s The Difference Between A Renovation Loan And A Personal Loan In Singapore?

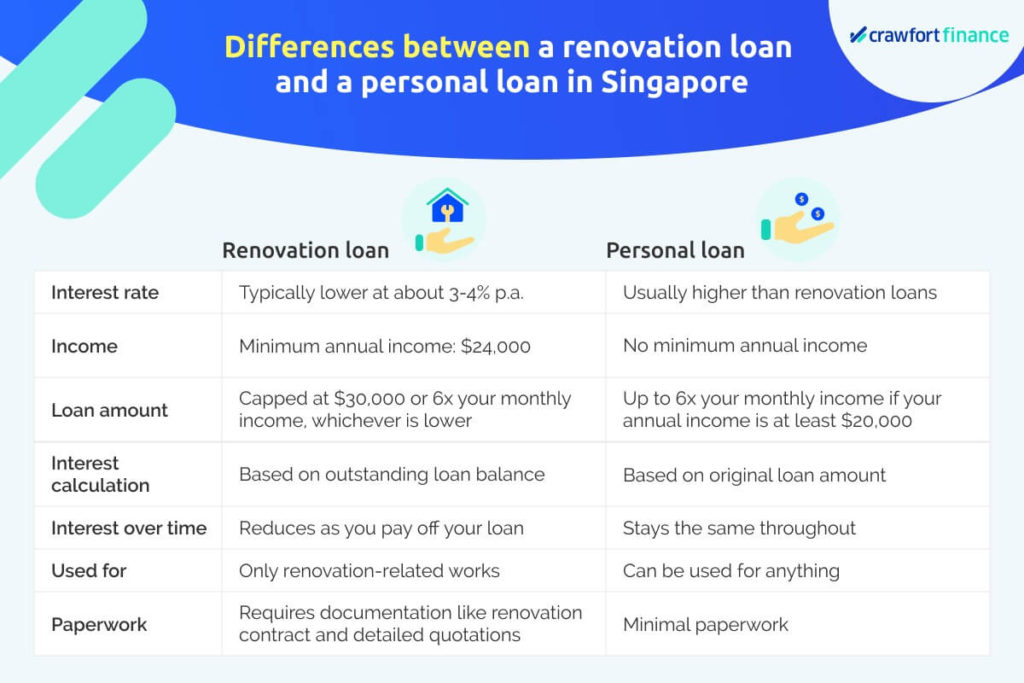

Renovation loans are specifically meant for financing your home renovation. On the other hand, personal loans are a fixed sum of money that you can borrow to use for any purpose.

Here are some other differences to take note of.

1. Interest

Let’s first compare renovation loans and personal loans from an interest rate perspective.

In general, renovations loans have lower interest rates than personal loans. Renovation loans have an interest rate of around 3 to 4% p.a.

Moreover, the interest for renovation loans and personal loans are calculated differently. The interest for renovation loans is calculated based on the outstanding balance of the loan. As such, the interest reduces as you pay off the loan.

For personal loans, the interest is calculated based on the original loan amount, and therefore your interest remains the same throughout.

Here’s a snapshot of the differences:

| Renovation loan | Personal loan | |

| Interest rate | Typically lower at about 3-4% p.a. | Usually higher |

| How the interest is calculated | Calculated based on outstanding balance of the loan. Monthly interest payable reduces over time as loan is paid. |

Calculated based on the original loan amount. Monthly interest payable remains the same. |

Looking for more financing options for your renovation? Learn about them here.

2. Minimum Income Requirements

To apply for a renovation loan in Singapore, the main applicant and joint applicant need to have a minimum annual income of S$24,000 and S$12,000 respectively.

You can still take out a personal loan in Singapore from a licensed money lender in Singapore if you don’t earn this much—since there’s no minimum income requirement. If you earn at least S$20,000 a year, you can also take a personal loan that’s up to 6 times your monthly income.

3. Loan Ceiling

The next question you probably have is how much you can borrow through a renovation loan and personal loan in Singapore.

In general, there is a lower loan ceiling for renovation loans compared to personal loans.

Renovation loans in Singapore have a ceiling of S$30,000 or 6 times your monthly income, whichever is lower. In some cases, this means a renovation loan might not be sufficient to cover the full cost of renovation.

For a personal loan in Singapore, you can borrow up to 6 times your monthly income from a licensed money lender as long as your annual income is at least S$20,000.

Here’s a table of the maximum amounts that you can borrow through a personal loan from a licensed money lender in Singapore.

| Annual Income | Singapore Citizens and PR | Foreigners living in Singapore |

| Less than S$10, 000 | Up to S$3,000 | Up to S$500 |

| Between S$10,000 to less than S$20,000 | Up to S$3,000 | Up to S$3,000 |

| At least S$20,000 | 6 times monthly income | 6 times monthly income |

4. Spending Flexibility

Although taking a renovation loan has the benefit of lower interest rates, it does come with some restrictions.

Renovation loans can only be used for approved renovation-related works such as tilework, paintwork, and electrical wiring. This means you won’t be able to use the funds for items such as furniture or installation of curtains. Additionally, the money will be disbursed directly to your contractor or interior designer company.

On the other hand, you can spend a personal loan on anything you want—be it a new sofa set or air-conditioning system.

5. Loan Tenure

Personal loans have a longer tenure than renovation loans.

While banks typically offer a period of 1 to 5 years to repay a renovation loan, you can have up to 7 years to repay a personal loan in Singapore.

However, do note that the longer your repayment period is, the more interest you’ll end up paying.

6. Amount Of Paperwork Involved

Taking out a renovation loan can be more tedious since lenders have to ensure the renovation loan is used for renovation purposes.

For example, you’ll need to submit the renovation contract or a detailed quotation to the lender, on top of other documentation like income documents.

But when it comes to taking a personal loan, there’s less effort and paperwork involved since there are no restrictions on what you can spend the money on.

Whether you’re taking a renovation or a personal loan in Singapore for your home renovation, always remember to make sure your finances are sound and you’ll have the means to repay the loan. After all, there’s no point renovating your home into something fancy, only to be overwhelmed with debt or even end up defaulting on the loan.