If you’re facing some kind of financial difficulty, getting a personal loan in Singapore could help improve your situation. Whether you choose to borrow from a bank or a licensed money lender in Singapore, you have a decision to make: you’ll need to decide whether to take out a secured personal loan in Singapore or an unsecured loan.

But what’s the difference between the two? And which should you take based on your current situation?

Situations In Which You Might Need To Take A Personal Loan In Singapore

If you lack funds for a short-term course, taking a personal loan could be an option to explore.

Before we compare secured and unsecured personal loans, you need to understand that taking a personal loan in Singapore isn’t a decision to be taken lightly. After all, you need to make sure you can pay it back on time with interest, so it’s best to make sure you’re ready to take one.

Here are some situations in which taking a personal loan in Singapore can be a viable option.

Unforeseen Financial Emergencies

Finding yourself in a financial emergency like being in an accident, experiencing a death in the family, or getting retrenched are some things that are beyond your control. Furthermore, you might still have to be responsible for ongoing financial commitments like bills and mortgage payments.

If you find yourself in such a situation, getting a personal loan in Singapore could help tide you over a difficult time.

For instance, your Medisave account and health insurance may not be enough to cover the full medical bill. In this case, you can take out a personal loan to pay off the remaining balance. You may also use the loan to pay for the medical bill in cash first, before you receive your insurance payouts.

Find out more about the types of personal loan that are suitable for emergencies here.

Taking A Vacation

Everyone needs a time off, and in some cases, your work might require you to take a fixed number of days off per year. To make the best out of your time off, you could take a personal loan and go on a nice vacation with your friends or family.

Taking A Personal Loan Can Help To Manage Your Expenditure

Another benefit of taking a personal loan for a holiday is that it makes it necessary for you to determine a budget. This may be useful in helping you plan and manage expenditure for your vacation, as well as ensure that you don’t spend beyond your means.

Taking A Personal Loan Is A Better Alternative To Credit Cards

Taking out a personal loan can also be a better option than using a credit card to pay for your trip.

While credit cards can provide you with the convenience of paying for something when you don’t have enough cash, especially local currency, they also make it easier for you to overspend.

There’s no set limit to how much you can spend with a credit card, as you’re essentially spending “future money”. And psychologically, it’s less painful to spend with future money than cash on hand. This makes it easier for you to spend extravagantly.

If you have a tendency to overspend and miss your payment due dates, using a credit card to pay for your trip can lead to a higher credit card bill.

On the other hand, having a fixed amount of cash from the personal loan can help reduce the chances of spending beyond your means.

Going for a trip soon? Here are some travelling tips to help you make the best out of it.

With that said, it’s crucial that you exercise good judgment and financial management to make sure you’re able to repay the loan eventually and on time.

Paying For Education

It’s important to get a good education and continuously upgrade one’s skills to not miss out on opportunities like a promotion or making a career switch to earn better income.

Given the changing needs of the economy and the recession, some jobs may also become obsolete. To remain employable, it’s recommended that you go for short courses to reskill.

However, education can be expensive, and you might find yourself not having enough funds to finance it. This doesn’t have to stop you from giving you or your child the best education possible, though. For starters, you can make use of the SkillsFuture Credit to pay for short courses.

The SkillsFuture Credit is only applicable for Singaporeans aged 25 and above. If you’re not eligible for the credit or have used up your allocated credit, taking out a personal loan to finance for short courses could be an option.

Wish to learn how a personal loan in Singapore could come in helpful? Read this article here.

Secured And Unsecured Personal Loans In Singapore: What’s The Difference?

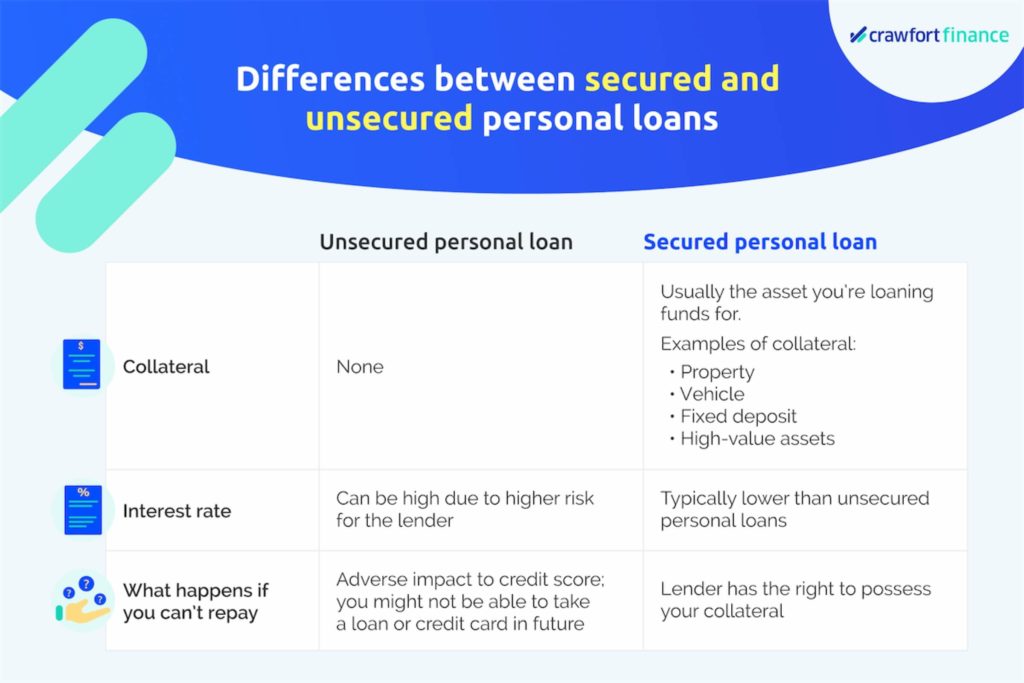

Now that we’ve laid out a few situations in which taking out a personal loan can be a feasible option, let’s dive into the differences between secured and unsecured loans.

Personal loans generally fall under two main categories: secured and unsecured.

Secured Loans

Secured loans are loans that require some type of asset as a condition of borrowing. Examples of secured loans include car loans and home loans. Pawning your valuables at a pawn shop is also considered as taking out a secured loan.

The asset becomes collateral for the loan and can usually be anything of value that you own. This may include property, vehicles like cars or motorcycles, other high-value assets like expensive jewellery, or even a fixed deposit. Should you default on the loan, the financial institution or licensed money lender has the power to repossess the collateral and sell it to recoup the losses.

Even after the lender has seized the collateral, it’s possible that this still doesn’t cover your loan repayment. This is known as a shortfall, which usually results with property or items that depreciate in value as time goes by.

Note that secured loans may have restrictions such as what you can use the funds for. If you’re planning on using the money to pay for a car, for example, you might be required to use the full amount to pay for it.

Conversely, secured loans from pawn shops don’t come with restrictions on what you can use it for, although they will ask you on the purpose of the loan.

Unsecured Loans

Unlike secured loans, lenders don’t require collateral when you’re taking out an unsecured loan.

Since there’s more risk on the part of the lender, unsecured loans tend to have higher interest rates than secured ones. Failure to repay the loan on time will result in a low credit score, which can create serious problems for you in future. This includes a lower chance of future loan applications being approved, and being unable to get a credit card. In some cases, it might even make securing a job difficult, especially in the banking and finance industry.

There are generally no restrictions as to what you can use the unsecured loan for—whether it’s to pay for medical bills or a vacation. Examples of unsecured loans include personal loans and payday loans, both of which can be used for any purpose.

One exception to this are renovation loans. While you don’t have to put up collateral to take out a renovation loan, there are restrictions on what you can use the money for. With a renovation loan, you can only use it to pay for renovation works such as electrical works, painting, and structural alterations. You won’t be able to use it for the purchase of new furniture.

Secured And Unsecured Personal Loans In Singapore: What Are The Pros And Cons?

Before you jump into applying for either a secured or an unsecured loan, it’s important to weigh each of their advantages and drawbacks.

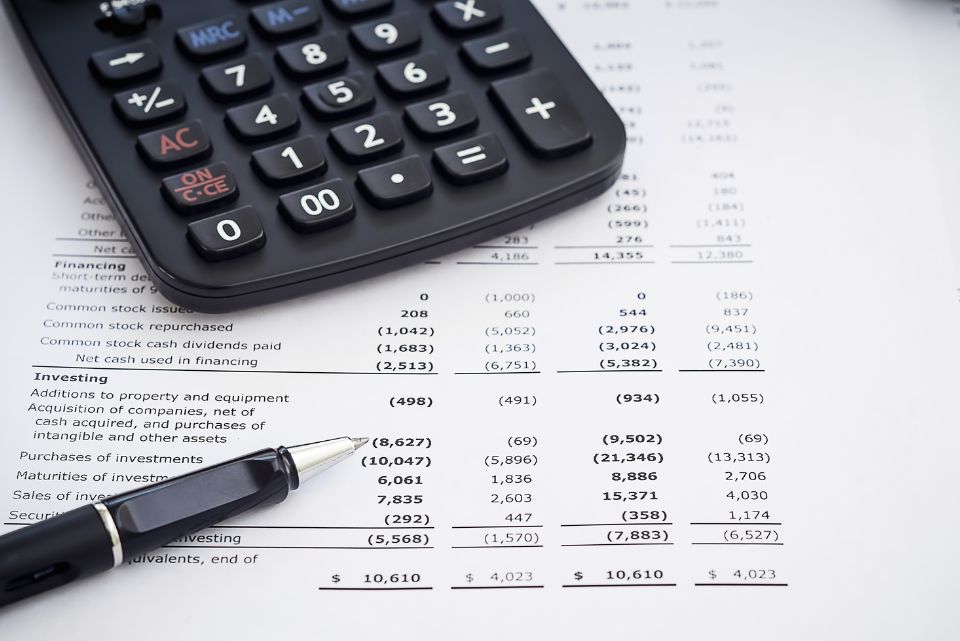

This table is a summary of the pros and cons of both types of loans to consider before you apply for one.

| Pros | Cons | |

| Secured personal loan | Approval chances are less affected by credit history You can generally take a higher loan amount Lower interest rate and fees |

Possibility of losing your collateral if you default You might still have to foot any shortfall after losing your collateral |

| Unsecured personal loan | No collateral is at stake | Higher interest rate Tends to be more difficult to obtain |

Secured Personal Loans

You may risk losing your car if you put it up as collateral for your secured loan.

Pros

You Can Generally Borrow More Money

By putting up a high-value asset like your house or car as collateral, you’re pretty much lowering the risk for the lender. This, in turn, means the lender would be more willing to lend you a greater sum of money.

Loan Access Is Less Affected By Bad Credit History

Even if you have a bad credit history, your chances of getting a secured personal loan in Singapore might not be that affected. As putting up collateral lowers the risk for the lender, this makes secured loans a potential option for those who need money urgently but don’t have a good credit record.

Wondering what are the ways to improve your credit score? Learn more about them here.

Lower Interest Rates And Fees

Due to lower risk for the lender, you’ll also get to enjoy lower interest rates compared to unsecured loans. Another advantage is that fees and charges for secured loans tend to be lower.

Cons

You Could Lose Your Collateral If You’re Unable To Repay Your Personal Loan

An obvious downside of secured loans is that if you fail to repay the loan, you could end up losing your collateral. If you put your car up as collateral, for example, the lender can sell it to pay off your debt should you default on your loan.

You Might Still Have To Repay Any Shortfall Even After Losing Your Collateral

As mentioned earlier on, if the value of your collateral is still not enough to cover your debt, you’re obligated to pay back whatever is remaining. This means you’ll not only lose your collateral, you also won’t be able to pay off your debt just yet.

Unsecured Personal Loans

Pros

No Collateral Needed To Get A Personal Loan

You don’t need any collateral to take out an unsecured personal loan, so you don’t have to worry about the risk of losing any assets of high-value. Instead, the lender will consider key aspects such as your credit history and annual salary when they process your application.

Unsecured loans are also generally known to have more flexible terms. For example, you can choose how you want to use the loaned amount—whether it’s to make a big purchase such as a new sofa or to invest.

Cons

Higher Interest Rates

Since there’s no collateral involved for unsecured loans, the risk for lenders is higher. This translates to higher interest rates than secured loans, since the lender has less means to recoup the costs if you default on the loan.

Usually More Difficult To Obtain Than Secured Loans

Unless you have a good credit history, unsecured loans are usually harder to obtain from banks than secured loans. Since there’s no collateral involved, lenders need evidence demonstrating that you have a good chance of repaying the loan.

This also means that if you have no prior credit history because you’ve never taken a loan or applied for a credit card before, it might be harder to get an unsecured loan.

Learn more about why a financial institution may reject your loan application here.

Find out more on what else you should consider before taking a personal loan here.

Choosing Between A Secured And An Unsecured Personal Loan In Singapore

When choosing between both loan types, it’s important to consider the different consequences for each should you be unable to repay.

In the case of secured loans, you could end up losing your collateral, so you’ll need to ask yourself if that’s something you can afford to deal with when it happens. Furthermore, you might even need to cover any shortfall.

When it comes to unsecured loans, you need to be sure that you’re capable of footing the higher interest. The consequences on your credit history will be severe if you default on your loan. You’ll most likely be unable to take out loans in future, such as to finance a new home.

After all, it’s normal for lenders to be wary of individuals who have a history of not repaying their debt. As mentioned earlier, defaulting could end up hurting your chances at landing a job.

What To Do If You Can’t Repay Your Secured Or Unsecured Loan?

The last thing both you and your creditors want is that you default on your loans. With that said, if you ever find yourself having difficulty repaying your loan on time, it’s essential to understand that you have a few options to settle your debt. Opting for any of these alternatives is always better than defaulting on your loan.

Renegotiate The Terms With Your Lender

Consider asking your bank or licensed moneylender for a lower interest rate or a longer loan tenure. Regardless of the terms, lenders are generally more willing to restructure your loan, rather than have you default on your loan.

On the flip side, do note that you may have to pay additional fees for this arrangement.

Take A Debt Consolidation Plan

The Debt Consolidation Plan (DCP) is a type of personal loan that allows you to consolidate your unsecured loan debts, including credit cards and personal loans. By doing so, you’ll only have to pay once a month to one lender for the various unsecured debts, making debt repayment more manageable for you.

On the contrary, do note that you can’t use the DCP for some unsecured loans, such as the following:

- Joint accounts

- Renovation loan

- Education loan

- Medical loan

- Credit facilities for businesses or business purposes

In addition, the DCP is only for those whose total unsecured debt exceeds 12 times of their monthly income.

Unsure if you should apply for the DCP? Learn more about it here.

Go For Credit Counselling

Another option is to go for a credit counselling session, in which a credit counsellor will advise you on how to manage your debt.

During this session, the counsellor will also assess if you should apply for the Debt Management Programme (DMP), which helps you to negotiate with your lenders for a more manageable repayment plan.

You’re eligible for the DMP if you have a total unsecured loan debt of at least S$10,000, own debts to multiple creditors, have account relationships with creditors for at least one year, and have a source of income to make regular repayments.

However, do note the restrictions that come with being on the programme. This includes having all your credit card and line accounts closed, and that you won’t be allowed to apply for any unsecured credit facilities.

Find out more about credit counselling and the DMP here.

Whether you’re planning to take out a secured or unsecured personal loan in Singapore, we hope this article has been helpful to you.

Thinking of taking up a personal loan? Reach out to Crawfort today.