It is tough sometimes when we land ourselves in unexpected situations that require immediate financial assistance, such as medical emergencies or investment opportunities. At times like this, taking out a personal loan in Singapore could be a viable option to ease your financial burden.

A personal loan is a type of unsecured loan that does not require you to put up any sort of security or collateral, for example, your house or a car.

It can also serve as your solution to pay for things like your travel costs, wedding expenses, investment plans, home renovation, as well as your debt.

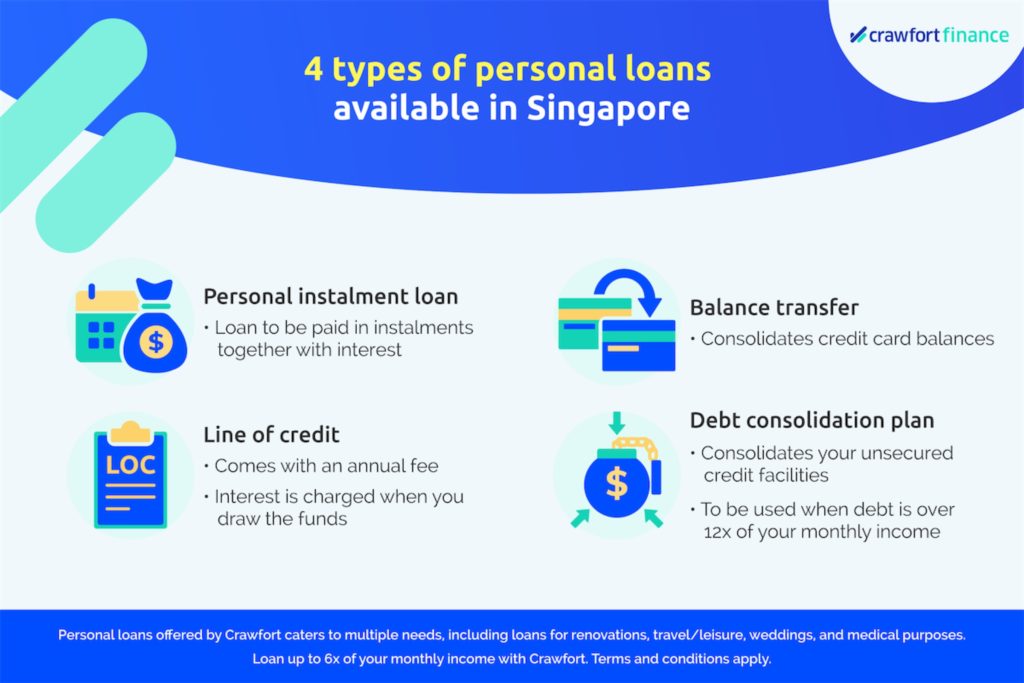

Before deciding on which personal loans suit your financial needs, here is a breakdown on the 4 types of personal loans in Singapore to help you make an informed decision.

1. Personal Instalment Loan

A personal instalment loan, or otherwise known as term loan, is a lump sum money that you can borrow from a bank or licensed money lender in Singapore.

It’s the most common type of personal loan among the lending industry. It can come in different names, depending on the banks or licensed money lenders, but the principle is the same.

Personal instalment loan is repaid in fixed instalments, typically of up to 60 months. It generally includes a one-time processing fee that ranges between 0% and 10% of the principal amount.

In addition, interest rates may vary across banks and licensed money lenders.

Personal instalment loans are useful when you need a substantial amount of money to cover a sudden and unavoidable big-ticket expense, such as medical emergencies or outstanding debts from multiple channels.

Here’s a table to illustrate the differences between taking a personal instalment loan from a bank and a licensed money lender in Singapore.

| Personal Instalment Loan | ||

| Provider | Banks | Licensed money lenders |

| Fees | One-time processing fee between 0% – 5% | One-time processing fee of up to 10% deducted upfront from each loan |

| Loan Amount | Up to 10x monthly salary | Up to 6x monthly salary |

| Interest Rate | Between 3.7% – 7% p.a. | Up to 4% per month (nominal interest rates start from 1.8% p.a. at Crawfort) |

| Loan Tenure | Between 1 – 7 years | Flexible |

Source: singsaver.com.sg, crawfort.com

You can use this loan for multiple needs such as for education and personal development, weddings, renovations, travel, leisure, and medical emergencies.

2. Personal Line Of Credit

A personal line of credit is a type of personal loan that allows you to withdraw from the account anytime you want. It’s pretty useful especially when you’re in urgent need of cash and you need it instantly.

The maximum amount that you can withdraw from the account is typically 2 times of your monthly income.

The caveat is that a personal line of credit comes with an annual fee ranging from S$60 to S$120, depending on the financial institution you’re borrowing from.

Plus, you’ll be charged interest the moment you withdraw the money, be it through an ATM, internet banking, or by going to the physical bank branch.

Generally, interest rates for this type of personal loan in Singapore vary from 18% to 22% p.a. You’ll be charged interest for as long as you borrow the money. When you’ve fully paid the funds, the bank will stop charging you interest.

It also does not have a fixed tenure period of repayment. So it’s entirely up to you to decide how long you want to repay the loan. But of course, the faster you repay, the less you’ll spend on repaying.

| Personal Line of Credit | |

| Provider | Banks |

| Fees | Annual fee between S$60 – S$120 |

| Loan Amount | Up to 2x monthly salary |

| Interest Rate | Between 18% – 22% p.a. |

| Loan Tenure | No fixed tenure |

Source: singsaver.com.sg

3. Balance Transfer

Balance transfer allows you to transfer your existing debt from multiple credit card debts to a single low-interest account or credit line.

This type of personal loan is often used to reduce interest payments and help consolidate multiple debts into one manageable account.

For instance, if you fail to pay your credit card balances in full and are charged with an interest rate of 18%, it could quickly become difficult to keep up with your payments.

Using a balance transfer enables you to pay for your credit card bills once a month, all while enjoying a low-interest rate as low as 0%.

In other words, if you pay off the credit card balances before the end of your balance transfer, you won’t have to pay any interest. Essentially, a balance transfer is a bit like an interest-free loan, allowing you to manage your debt and monthly repayments better.

The repayment term varies depending on the banks. Most banks offer 6-month and 12-month terms, with a few offering 3-month and 18-month terms as well.

The downside of a balance transfer is that the balance can snowball if it’s not fully paid by the end of the repayment term. This is because the interest rate will change back to the initial interest rate of the credit card, which can be as high as 30%.

| Balance Transfer | |

| Provider | Banks |

| Fees | One-time processing fee between 1% – 5% of balance transfer amount |

| Loan Amount | Up to 4x monthly salary |

| Interest Rate | Interest-free for a limited time, 17% – 28% interest rate after |

| Loan Tenure | Between 3 – 18 months |

Source: singsaver.com.sg

4. Debt Consolidation Plan

The Debt Consolidation Plan is a debt restructuring programme that helps you to consolidate all your unsecured credit facilities at various financial institutions into a single financial institution at a lower interest rate.

Unsecured credit facilities that you can consolidate with this programme include credit cards and personal loans.

The main difference between a balance transfer and a Debt Consolidation Plan is that the latter is used when your debt exceeds 12 times of your monthly income. In such a situation, the Debt Consolidation Plan can help you manage your debts better.

When approved, all your unsecured credit facilities are closed and consolidated into a single Debt Consolidation Plan account. You can then repay all your unsecured debts once a month through the account, for a term of up to 10 years. It’s pretty useful especially when you have trouble paying off your unsecured loans to various banks every month.

Do take note that you can only have 1 Debt Consolidation Plan active at any one time. After 3 months, you can choose to refinance your existing Debt Consolidation Plan with another participating bank, if you find one with lower interest rates.

Additionally, the Debt Consolidation Plan is only applicable to loans that you borrow from participating banks and financial institutions in Singapore. Plus, certain types of unsecured loans are excluded from the programme, such as the following:

- Joint accounts

- Renovation loans

- Education loans

- Medical loans

- Credit facilities granted for businesses or business purposes

| Debt Consolidation Plan | |

| Provider | Banks |

| Fees | One-time processing fee between 0% – 3% of loan amount |

| Loan Amount | Up to 18x monthly salary |

| Interest Rate | Between 3.18% – 12% p.a. |

| Loan Tenure | Between 1 – 10 years |

Source: singsaver.com.sg

Thinking of consolidating your debt? Find out how you can do so with a personal loan.

These are the 4 types of personal loans you can find in Singapore.

Personal loans are useful when you need extra cash. However, you should keep in mind that there are advantages and disadvantages when it comes to getting a personal loan in Singapore. Read more about what you should take note before taking out a personal loan here.

Ready to apply for a personal loan? Apply now with Crawfort.