The past few months have been difficult for many people in various industries. Most businesses, especially in the service industry, have been badly affected by the COVID-19 social distancing measures. Taking a personal loan in Singapore is one option to get through this tough time.

Ever since the outbreak began, less people have been going out. This has affected livelihoods from all walks of life, including private-hire drivers such as Grab and Gojek drivers, as well as taxi drivers.

In fact, there’s been a fall of up to 40% in taxi and private-hire driver earnings. Despite the fact that they’re providing essential services, the lack of customers have been hitting them hard.

While the number of customers has greatly reduced, daily expenses to upkeep the car remains the same.

Plus, the waivers and subsidies given by the government might not be enough to cover the costs.

To tide over this financial difficulty, one of the options available, if you’re a private-hire or taxi driver in Singapore, is a personal loan.

What’s A Personal Loan For?

A personal loan is a lump sum of money borrowed from a financial institution, such as a bank or a licensed money lender. You’ll need to pay back the money borrowed in instalments over an agreed-upon period of time.

In general, personal loans in Singapore can be useful in emergencies and unforeseeable situations that abruptly affect your income. For example, for most people, the COVID-19 outbreak has caused a sudden drop (or halt) in their income.

In times of low demand and uncertainties (such as the impending recession and the pandemic), it’s challenging to earn just enough money to cover daily expenses such as car rental and petrol. However, having a lump sum of cash from a personal loan can significantly ease your financial worries. It can be useful especially if you need cash urgently to pay for these day-to-day operating expenses.

Plus, it can help to ensure that you have sufficient funds for the maintenance of your car, allowing you to continue working.

Learn more about how personal loans work here.

How Is A Personal Loan Useful For Private-Hire Drivers?

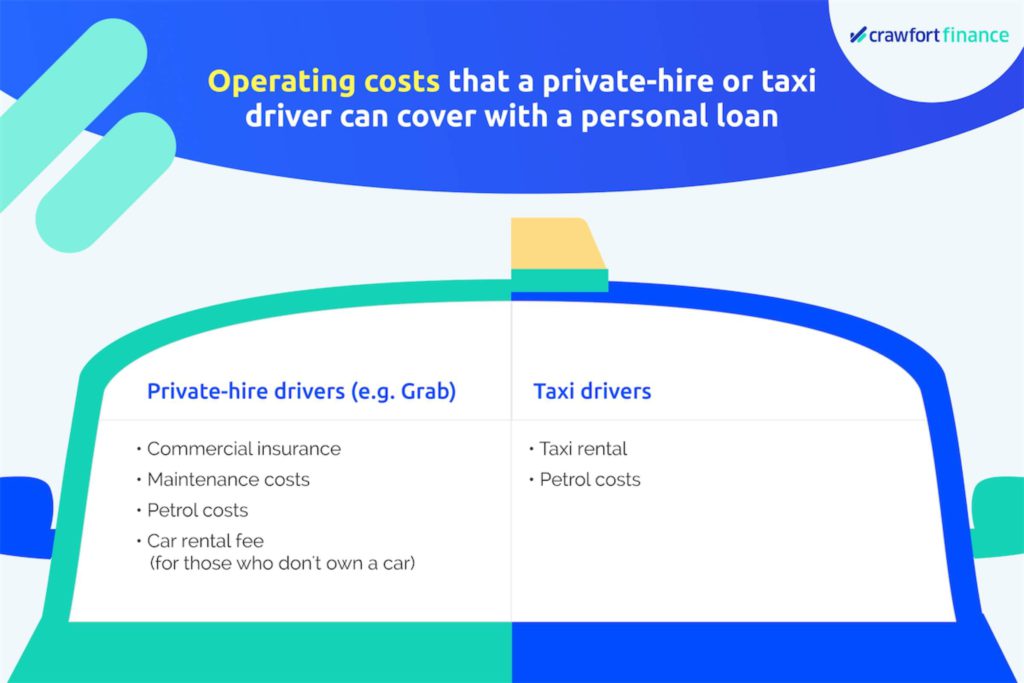

Instead of dipping into your savings, you can take out a personal loan in Singapore to cover some of the operating expenses, especially during this time when there’s low demand.

As compared to taxi drivers, the daily operating cost for private-hire drivers can be quite high.

If you’re using your own car, here are some of the operating costs that you may pay using a personal loan:

- Commercial insurance

- Maintenance and servicing

- Petrol

Commercial Insurance

Commercial insurance for a car is about S$2,000 to S$3,500 per year.

Let’s assume that the insurance for your car costs S$2,750.

For instance, you work a 5-day work week, every week of the year. This makes it 52 weeks — in 1 year, you would have gone to work for 260 days.

It means that for every working day, you’re paying an insurance cost of S$10.60.

And this cost is before adding in maintenance and petrol costs.

Maintenance Costs

On average, car servicing can cost around S$500 per year, which translates to a daily cost of around S$2.

There’s also a greater need for private-hire cars to go for car wash more frequently to maintain the external appearance and cleanliness.

The average price for a basic car wash is S$10. This makes the general maintenance and servicing costs to be S$12 daily.

Petrol Costs

Out of these expenses, petrol costs take up a bulk of it. For instance, petrol can easily cost you S$50 to S$80 daily. What’s worse is that during off-peak seasons, you’re picking up less customers, but use the same amount of petrol to drive around the island, hoping to pick up customers along the way.

For Car Rental

The good thing about renting a car is that you won’t need to pay for the costs of commercial insurance and maintenance.

However, you’ll still have to pay for the petrol and car rental fee. The car rental cost averages between S$40 and S$80 per day.

Whether you’re using your own car or a rental car, taking a personal loan in Singapore can help to cover these operating costs, as well as to ease your financial burden when demand is low.

How Is A Personal Loan Useful For Taxi Drivers?

Just like private-hire drivers, you may opt for a personal loan instead of using your savings to pay for some of your operating costs when demand is low. Your savings, for instance, can be set aside for more urgent payments.

In general, some of the operating costs that you can pay using a personal loan are:

- Taxi rental

- Petrol costs

Taxi rental costs an average of S$75 to S$105 daily. It’s generally more expensive than the rental cost for private-hire cars.

The daily cost of petrol for taxi drivers is slightly cheaper, at approximately S$30 to S$50. However, given the current situation, you might be using the same amount of petrol but won’t be able to pick up enough customers to cover the cost.

Here’s an estimation of the daily operating cost for private-hire cars and taxis:

| Private-hire (e.g. Grab), with own car | Private-hire (e.g. Grab), with rental car | Taxi | |

| Commercial insurance | S$10.60 | N.A. | N.A. |

| Maintenance (e.g. car wash, servicing) | S$12/day | N.A. | N.A. |

| Petrol costs | S$65/day (average between S$50 to S$80) | S$65/day (average between S$50 to S$80) | S$40/day (average between S$30 to S$50) |

| Rental cost | N.A. | S$60/day (average between S$40 to S$80) | S$90/day (average between S$75 to S$105) |

| Total/day | S$87.60 | S$125 | S$130 |

Daily expenses just to upkeep the car itself can be quite high. And in times of low demand due to situations such as the pandemic, paying for these expenses becomes even harder especially when less customers are riding.

What Are The Documents Needed To Apply For A Personal Loan In Singapore As A Driver?

Applying for a personal loan in Singapore is quite simple, especially if you’re borrowing from licensed money lenders.

In general, these are all the documents you’ll need:

- Proof of identity, e.g. NRIC

- Proof of income, e.g. payslip

It’s essential to submit your proof of income as the amount that you can borrow depends on your annual income.

How Much Can You Borrow As A Driver Through A Personal Loan In Singapore?

Before you jump into taking a personal loan in Singapore to cover your private-hire or taxi operating costs, do take note of the maximum amount that you can borrow.

The amount typically depends on 2 factors: your income and credit score.

Annual Income

Generally, the more you earn, the more you can borrow.

If you earn at least S$20,000 annually, you can borrow up to 6 times your monthly income.

That means if you’re a taxi driver earning the average monthly income of S$4,330 (which translates to an annual income of S$51,960), the maximum amount you’ll be able to borrow is S$25,980!

If you’re a full-time private-hire driver earning an estimated monthly income of S$5,104, you’ll be able to take out a maximum loan amount of S$30,624.

However, you should only borrow based on your capacity and needs, for instance, to cover your car rental or taxi rental costs. It’s not recommended that you borrow the maximum amount; this helps to ensure that you’ll be able to pay back your loans on time.

Credit Score

Your credit score may also be evaluated when you apply for a personal loan in Singapore.

Essentially, a credit score indicates how likely you’re going to repay your debts. It’s not fixed, and will change based on your actions. For example, if you keep making late payments, your credit score will drop.

Having a higher credit score makes it easier for you to take out a personal loan in Singapore. It allows you to borrow more money too.

In general, banks are more particular about credit scores, while licensed money lenders tend to focus less on them when approving loans.

But if you’ve never borrowed a loan as a driver, or held a credit card before, chances are you don’t have a credit score. Not to worry, you can start building up your credit score by taking out small personal loans and paying them back on time.

Or if you have a credit score and it isn’t very good, you can consider going to a licensed money lender instead of a bank to take out a personal loan in Singapore.

Learn more about how you can get a personal loan in Singapore with a bad credit score here.

What Do You Need To Consider When Taking A Personal Loan In Singapore?

While getting a personal loan in Singapore can be very helpful in covering the operating costs of your private-hire car or taxi, there are some aspects that you should always pay close attention to before getting one.

Interest Rates

Before taking a personal loan, it’s always handy to compare the interest rates from banks and licensed money lenders.

While licensed money lenders in general tend to have higher interest rates than banks, the former have a faster approval rate.

This is especially useful when you need cash urgently, for instance to pay for petrol. At Crawfort, you can get your loan approved within as fast as 8 minutes — the same amount of time taken to pay and pump your petrol!

In fact, Crawfort’s nominal interest rate starts from 1.8% per annum.

Should you encounter any money lender that offers loans with interest rates of more than 4% per month, they might be unlicensed money lenders or loan sharks.

Always consider the interest rates carefully before taking a personal loan! The last thing you want is to find out that you’ve overcommitted to a loan with a high-interest rate that’s not within your means.

Loan Repayment Schedule

Loan repayment schedule refers to the number of instalments and frequency of instalments.

Some financial institutions have a predetermined and more rigid loan repayment schedule. For instance, for most personal loans in Singapore, the loan repayment is through monthly instalments.

However, given that income for private-hire and taxi drivers varies depending on demand, it can be hard to make the repayments monthly. So paying your loans in monthly instalments may not be a suitable option.

On the other hand, Crawfort offers a more flexible repayment schedule, making it easier for you to pay off your loan. If you’re planning to borrow from us, you can choose either one of the following options:

- Weekly

- Bi-weekly

- Payday

- Monthly

With this flexibility, you can plan your driving trips ahead and manage your repayments better.

Total Cost

The total cost isn’t just the amount you’re borrowing. It includes the principal amount, interest, and the administrative fee.

Administrative Fee

When it comes to taking out a personal loan in Singapore, most people overlook the administrative fee. In general, administrative fees can be around 0% to 3% for banks, and up to 10% for licensed money lenders.

Should you choose to borrow from a licensed money lender to pay for the operating costs of your private-hire car or taxi, be sure to check that the administrative fee is not more than 10% of the principal amount. You should also ensure that you’re not charged with any hidden fees.

If it’s more than 10%, or if you’re asked to pay for a processing fee before your loan is approved, chances are that you’re dealing with an unlicensed money lender.

Late Fees And Late Interest

In addition, it’s good to take into account any late fees and late interest that might be incurred.

Missing repayments can set you back and incur more debt. It might potentially cause a debt spiral too if it’s not settled in time.

Should you find yourself unable to pay back your loan repayments on time, be sure to consult your lender for other alternatives. Ask them for an extension, or if it’s possible to restructure the repayment.

This is better than incurring late fees, especially if it happens frequently.

Lenders such as banks and licensed money lenders can help in restructuring your repayments. So don’t hesitate to reach out to them if you can’t meet your loan repayment by the deadline.

What Else Can I Use A Personal Loan For?

The good thing about personal loans is that you can use it for all kinds of purposes, and not just to cover the operating costs of your private-hire car or taxi.

Here are other situations in which a personal loan can come in handy.

For Vacations

For instance, you might want to go on a dream vacation after the COVID-19 measures have ended and travel restrictions have been lifted.

Airlines are currently offering plane tickets at a low price for flights in the next several months. So it seems like a once-in-a-lifetime opportunity to go to places like Europe might just be coming your way. Yet you may not have enough cash to pay for it. What should you do?

Instead of forgoing this opportunity, you might want to take out a personal loan! With the lump sum of money, you can book and pay for travelling expenses such as the air tickets and accommodation first, allowing you to enjoy yourself without any worry.

You can then pay back the personal loan in instalments after your holiday (or even before your holiday, given the current travel restrictions).

For Upgrading Your Skills

Personal loans in Singapore can also help with your personal growth. If you want to upgrade your skills, such as taking a short-term course, you may either use your SkillsFuture Credit or a personal loan to pay for it.

For instance, if you’ve used up all your SkillsFuture Credit, you can continue to take up courses on investing by paying it with a personal loan.

These new skills can come in handy and provide you with other sources of income and opportunities when demand for taxi or private-hire is low, especially during this outbreak.

For Emergencies

A personal loan can also come in handy in times of emergencies. In the unfortunate event that an accident happens, you’ll need to foot hospitalisation bills. Medical bills in Singapore can be costly, especially if you don’t have the right insurance coverage.

In such a situation, you can take out a personal loan in Singapore to temporarily bear the cost. It will help ease the financial burden and let you focus on recovery.

In addition, with a personal loan, you won’t have to ask your relatives or friends to borrow from them, especially if they’re equally tight on money.

For Urgent Payments

Personal loans in Singapore are also known to be processed quickly, especially those from licensed money lenders.

The quick approval time for personal loans in Singapore means that it can be used to clear off urgent payments as fast as possible. If you’re borrowing from Crawfort, you can get your loan approved within 8 minutes!

If you have credit card bills due soon, a personal loan can give you the cash needed to pay it off first. Doing so will also prevent your credit card balances from snowballing and incurring more interest.

Still unsure about when you should take out a personal loan? Read here to find out more!

Ultimately, having the right support is crucial, especially in a time of low demand. During this COVID-19 outbreak, most of us will be hit hard financially, especially those working in the service industry.

Getting a personal loan, especially during this time, can go a long way in helping to lessen your stress and financial difficulties.

Whether it’s to cover the operating expenses of your private-hire car or taxi or to pay off urgent payments, that extra monetary aid can temporarily help tide you over.

Ready to apply for a personal loan? Get started with Crawfort today.