It’s always good when we receive a heads up before something happens, so that we can prepare for it.

But that doesn’t happen all the time. You can never predict when something unexpected crops up, and when you need extra cash urgently. In such times, a personal loan can be a viable option.

Types Of Emergencies In Which A Personal Loan Can Be Useful

One main feature of a personal loan is that you can get a lump sum of cash quickly, which is useful in times of emergencies. And during a time of a pandemic and economic downturn, taking out a personal loan can be more useful now than ever to ease your financial burden.

1. Medical Emergencies

A possible scenario in which a personal loan in Singapore may come in handy is when an emergency surgery is needed.

Whether or not it’s because of a disease, injury, or accident, a personal loan can be used to cover some of these medical expenses.

Given that medical bills can be very costly here in Singapore, your Medisave account and health insurance may not be sufficient to cover all the costs. Additionally, you may be required to pay your medical bills in cash before you can receive your insurance payouts.

When there isn’t enough cash on hand to pay for these bills, a personal loan in Singapore can offer you quick cash to pay for it.

2. Funeral

In the unfortunate event that a close family member passes away unexpectedly, you may require additional financial assistance to pay for the funeral costs.

In Singapore, funeral expenses can range from S$1,300 to S$8,400, which is a hefty sum. They include procedures such as embalming, placing the obituary in the newspaper, and burial/cremation costs.

A personal loan can also help to cover some of these costs.

3. Family Emergencies

Other kinds of emergencies include the sudden loss or massive decrease in income.

In such a situation, taking out a personal loan in Singapore can help assist you in paying your outstanding bills.

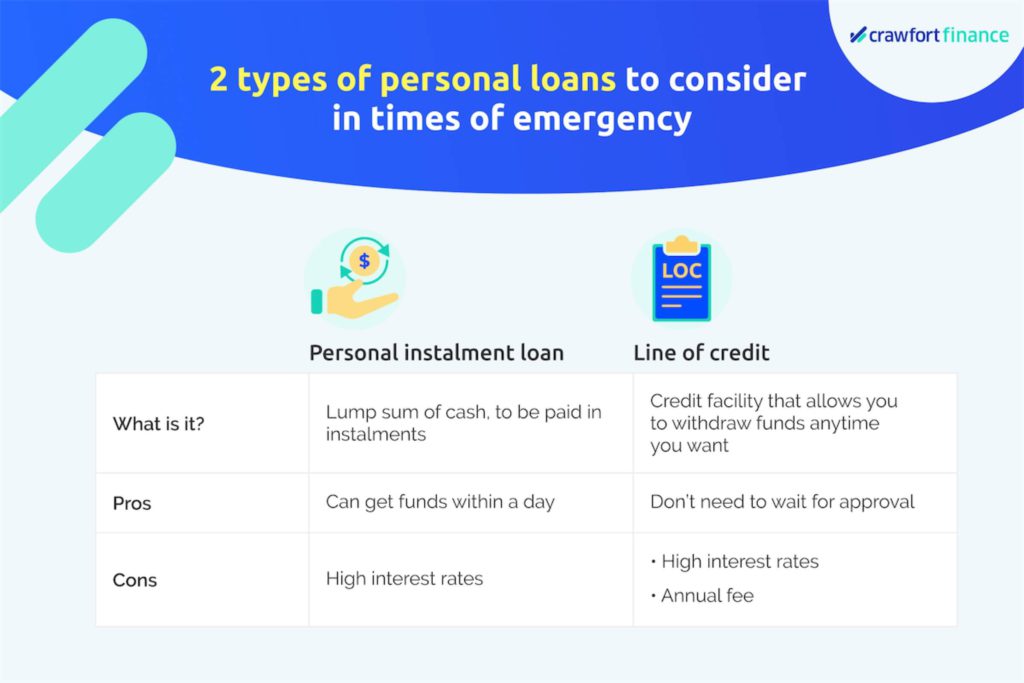

What Are The Types Of Personal Loans In Singapore That You Can Apply For During Emergencies?

1. Personal Instalment Loan

One of the most common types of personal loan in Singapore is a personal instalment loan.

It allows you to borrow a sum of money and pay it back in instalments. The period of repayment can last from a few months to a few years.

In addition, a fixed interest rate is charged to the amount borrowed. You’ll also need to pay additional fees such as the administrative fee and late fees (should you miss your repayment due date).

The interest rate differs depending on the lender, but it should not be more than 4% per month if you’re borrowing from a licensed money lender. In the same vein, the administrative fee should not exceed 10% of the principal amount.

As for the loan amount that you can borrow, it generally depends on your annual income. The higher your income, the higher the loan amount.

Do take note that when taking out a personal loan from the bank, there’s usually the minimum annual income requirement of S$30,000.

However, at licensed money lenders such as Crawfort, you can still get a personal instalment loan in Singapore even if you have an annual income of less than S$20,000.

Here’s a table to summarise what taking out a personal instalment loan in Singapore entails:

| Personal instalment loan | |

| What is it? | Allows you to get a lump sum of cash, to be repaid in instalments |

| Interest rates | Depending on the lenderLicensed money lenders can only charge up to 4% per month |

| Administrative fee | Depending on the lenderLicensed money lenders can only charge up to 10% of principal amount |

| Annual income requirement | Banks: Typically S$30,000 Licensed money lenders such as Crawfort: Less than S$20,000 |

Advantages Of Personal Instalment Loans

Fast Approval Of Your Application

One good thing about personal instalment loans in Singapore is that they come with fast approval.

Licensed money lenders, for instance, generally look at your income level to ensure that you can pay off the loan. They usually approve your loan as long as you meet their requirements.

This makes the loan approval process faster. In fact, licensed money lender such as Crawfort can process and approve your loan within 8 minutes.

No Collaterals

This is another distinctive feature of personal instalment loans. They are “unsecured”, which means that they’re not bonded to a collateral — a house, for instance.

In other words, if you find yourself unable to pay off your loan, you won’t risk losing your assets as the lender won’t be able to seize them.

Drawback Of Personal Instalment Loans

High-Interest Rates

Because of the less stringent requirements and lack of collateral needed to get a personal instalment loan, it comes with higher interest rates.

Banks can charge interest rates ranging from 3.7% to 7% per annum, while licensed money lenders can charge up to 4% per month.

At Crawfort, you can get a personal instalment loan with an interest rate starting from 1.8% per annum.

2. Line Of Credit

A line of credit is a type of personal loan, which allows you to withdraw funds anytime you want.

Once you withdraw from the account, you’ll need to pay an interest of around 18% to 22% per annum. The interest will be charged based on the duration of your loan.

In addition, there is no fixed tenure, so you can have this facility for as long as you want. Once you’ve fully paid your loan, no interest will be charged to you.

Here’s a table to summarise what taking out a line of credit entails in Singapore:

| Line of credit | |

| What is it? | Allows you to withdraw funds anytime you want, be it from the ATM, internet banking, or a physical bank branch |

| Interest rates | To be charged only when you withdraw the fundsCan range from 18% to 22% per annum |

| Annual fee | To be paid regardless of usageCan range from S$60 to S$120 |

Advantages Of Line of Credit

Convenience Of Withdrawing Money

One of the best things about the line of credit is that you can withdraw money whenever you want, via the ATM, internet banking, or going to the physical bank branch. This is especially useful in times of emergency, as you can get funds quickly from various channels of the bank.

No Need To Wait For Approval

You can also use the credit line as your source of standby cash for unexpected expenses. Unlike a personal instalment loan, you can get the cash instantly, without having to wait for its approval.

Drawback Of Line Of Credit

High-Interest Rates

Similar to a personal instalment loan, a line of credit comes with high-interest rates too.

As mentioned earlier, this can range from 18% to 22% per annum, and is charged when you withdraw money from the credit facility.

Annual Fee

In addition, you’ll need to pay an annual fee to have this credit facility, whether or not you withdraw money from it. So having a line of credit is only ideal when you need extra cash instantly to pay for urgent expenses.

Learn more about the various types of personal loan in Singapore here.

What To Consider When Taking A Personal Loan During Emergencies?

Before diving into your personal loan application in Singapore, be sure to consider these 3 factors.

Interest Rates

Whenever you’re planning to borrow money, do not just look at the rates of one lender or solely rely on information from family and friends. It’s good practice to shop around for the best rates offered by the various banks and licensed money lenders in Singapore.

In addition, the Ministry of Law (MinLaw) has stipulated that all licensed money lenders in Singapore can only charge an interest rate of at most 4% per month. Do look out for this if you plan to borrow from a licensed money lender.

Fees

Another thing to take note of is the fees that you’ll be charged, such as the administrative fee and late fees (if you miss your repayment).

Keep in mind that a licensed money lender in Singapore will charge you a processing fee only after the loan is approved.

If you’ve been asked to pay for this processing fee beforehand, be sure to inform the authorities. It’s an indication that you’re dealing with an illegal money lender, or a licensed one that’s violating the law.

Repayment

As a general rule of thumb, when it comes to borrowing money, one of your top priorities should be ensuring that you can pay back the loan.

Ensure that the repayment arrangement is suitable for you — whether it’s the frequency of repayment or the instalment amount you have to pay each time.

Do keep in mind that defaulting your repayment can be detrimental to your credit score, which may affect future loan applications.

Find out what else can bring down your credit score here.

In addition, missing your repayments can incur late fees. So it’s good to pay back your loans on time.

When unexpected costs arise, taking out a personal loan may not have been your first option. You may have chosen to borrow from family and friends, or approach the social services.

However, all is not lost when these 2 options are out of reach. Keep in mind that you still have the option to use a personal instalment loan or a line of credit in Singapore to get that extra cash quickly.

In need of cash for an emergency? Apply for a personal loan now with Crawfort.