We’re often told to continuously upgrade our skills because we need to stay relevant in times of changing needs. And one way to do that is through taking up courses. Plus, doing so can be helpful when we choose to switch careers.

But taking up courses in Singapore can be quite expensive. For instance, a one-day blockchain course can cost around S$800, while a digital marketing course can cost S$1,700.

That’s quite a hefty sum to fork out at once, especially when you don’t have that much disposable cash at hand.

In addition, when it comes to taking up short-term courses in Singapore, you won’t be able to get an education loan, student loan or a study loan to pay for it. So it’s easy to use cost as an excuse to put off learning new skills.

However, given the current COVID-19 situation and impending economic recession, business needs are changing. It’s becoming more crucial for us to stay relevant to ensure that we remain employable. So, short courses are a good investment that will pay off in the long run — if you can afford them.

But if you don’t have much cash on hand, are there ways to cover the cost for these courses?

One way is to use your SkillsFuture Credit.

Alternatively, you may also consider taking a personal loan in Singapore to pay for these short-term courses.

Thinking of taking a short-term course soon? Find out where you can take it here.

What Is SkillsFuture Credit?

SkillsFuture Credit is a S$500 open credit given by the government for Singaporeans to pay for eligible courses. The aim of this initiative is to encourage lifelong learning among Singaporeans, ensuring that we stay relevant in the workforce.

Even though the government subsidy covers up to 90% of course fees for these eligible courses, there’s still that remaining cost that we have to pay. This amount can be paid using the SkillsFuture Credit.

Plus, these credits don’t expire and the government will provide periodic top-ups, so you can accumulate your credits for future courses.

Credit Top-up

The government is providing a one-time S$500 credit top-up for Singaporeans aged 25 and above in 2020.

This one-off credit top-up can be used for more than 8,000 courses offered by the Institutes of Higher Learning (IHLs) and NTUC LearningHub from 1st April 2020 onwards.

From 1st October 2020 onwards, this amount can be used to pay for the full range of SkillsFuture Credit-eligible courses. The top-up will expire on 31st December 2025.

Mid-Career Support

In addition, for Singaporeans aged 40 to 60 years old, there’s the mid-career support provided through an additional one-off credit of S$500. This is meant to improve their access to career transition programmes.

This additional sum will also be valid until 31st December 2025 to give individuals ample time to reskill for new career opportunities.

Here’s a summary of the amount of SkillsFuture Credit and top-up you’ll get based on your age:

| Type | SkillsFuture Credit | Credit Top-Up | Mid-Career Support |

| Amount | S$500 | S$500 | S$500 |

| Expiry | No expiry | 31st December 2025 | 31st December 2025 |

| Eligible courses | Full range of SkillsFuture Credit-eligible courses | Can be used for full range of SkillsFuture Credit-eligible courses from 1st October 2020 | Selected courses only |

| Additional requirements | Singaporeans that are 25 years old and above | Singaporeans that are 25 years old and above | Singaporeans that are 40 to 60 years old |

With the additional credits provided, it’s a good opportunity to pick up new skills now!

There are many courses you can take with the SkillsFuture Credit, such as graphic design, financial planning, baking, flower arrangement, or even a new language.

Plus, the large variety of courses available makes it easier for people to diversify and change industries.

But what if you can’t use your SkillsFuture Credit to pay for your short-term courses? That’s when a personal loan in Singapore can come in handy.

Wondering what a personal loan is all about? Read here to find out more about how it works.

When Should You Take A Personal Loan In Singapore To Upgrade Your Skills?

Like most things in life, there’s a limit to how much we can use something. The same goes for using the SkillsFuture Credit.

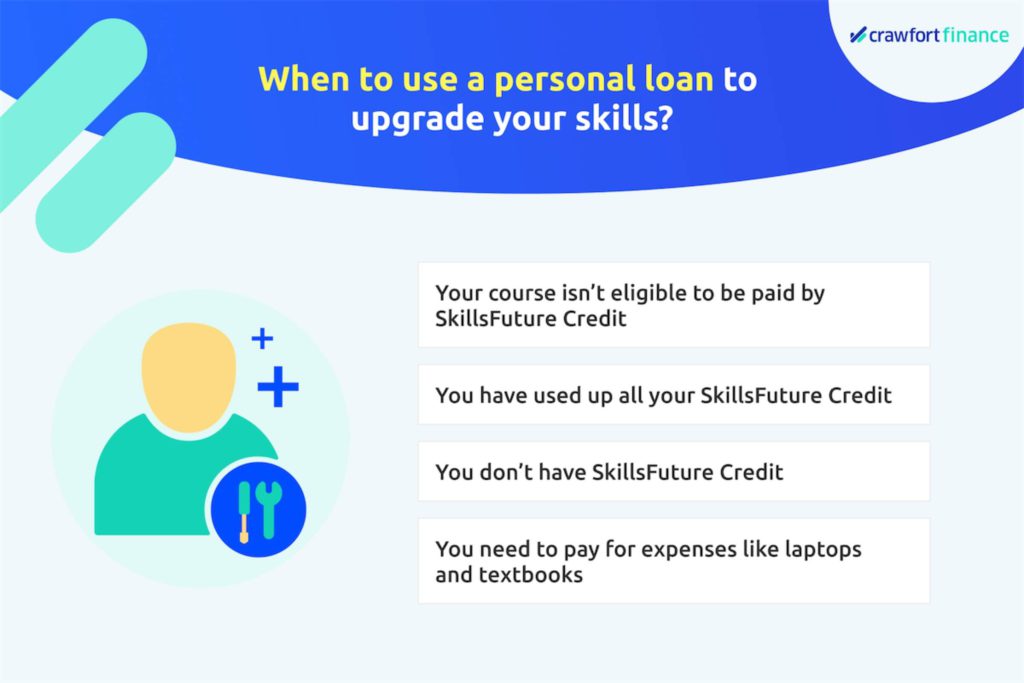

Here are some scenarios where a personal loan can come in handy to cover the cost of your courses.

When Your Course Isn’t Eligible To Be Paid By SkillsFuture Credit

Unfortunately, SkillsFuture Credit doesn’t cover all the courses out there.

If the short-term course that you’re planning to take is not on the list of eligible courses, you’ll have to find alternative ways to pay for them.

Instead of changing courses, tapping on your emergency funds, or scrimping to pay for it, consider taking a personal loan in Singapore instead.

With a personal loan, you can use the lump sum of money to pay for the course even if it can’t be paid with your SkillsFuture Credit.

When You Have Used Up All Your SkillsFuture Credit

Your SkillsFuture Credit account only has a value of S$500. And another S$500 can be used starting from 1 April 2020. While this might sound like a lot of money, courses are generally quite expensive. The average course, even with government subsidy, can be approximately S$300 to S$500.

This means that the total of S$1,000 credit can only be used to pay for 2 to 3 courses. So your SkillsFuture Credit alone might not even be enough to cover for all the short-term courses you plan to take.

Rather than choosing to stop going for classes, you can continue upgrading your skills by taking a personal loan to cover the cost instead. With that, you can fully concentrate on your learning without any financial worries.

When You Don’t Have Any SkillsFuture Credit

The thing about the SkillsFuture Credit is that you’ll only get it at the age of 25. This means that if you’re planning to take up short-term courses before you turn 25, you’ll need to bear the full cost of them.

Plus, if you’re a PR or a foreigner based in Singapore, you won’t be eligible for these credits.

But don’t let these limitations hinder your learning opportunity! Even if you don’t have the SkillsFuture Credit, you can still opt for a personal loan to upgrade your skills in Singapore.

Planning to take up a personal loan soon? Find out if you’re eligible for it here.

When You Need To Pay For Additional Expenses Besides Course Fees

Another thing about the SkillsFuture Credit is that it can only be used to pay for course fees. If you need additional resources, such as laptops, textbooks, software, and other course materials, you won’t be able to use the credits to pay for them.

Costs for these materials can be quite hefty. A laptop is at least S$1,000, and textbooks can amount to at least S$50.

Similarly, if you’re in a graphic design course, you might need to purchase software such as Adobe Illustrator or Adobe Photoshop. These can easily cost you S$30 per month.

But with a personal loan, you can get some quick cash to cover for these expenses.

Ultimately, a personal loan in Singapore can come in handy for when you want to upgrade your skills, especially when you can’t use SkillsFuture Credit.

Besides borrowing from banks, you may want to consider borrowing from a licensed moneylender. Personal loans from licensed moneylenders, in particular, have a faster processing rate than banks. This allows you to quickly pay for your course instead of waiting longer for the loan to be approved.

Plus, if you’re taking a popular course, having a shorter waiting time for your loan approval would be advantageous.