Besides being symbolic of financial independence and adulting, owning a credit card is a great way to earn rewards and cashback on your spending as long as you pay your bills dutifully every month. But what if you’re unable to pay your bills on time? With sky-high interest rates and a few late payment fees, your credit card debt may spiral out of control. Thankfully, you’re not out of options, and a personal loan in Singapore can come in useful.

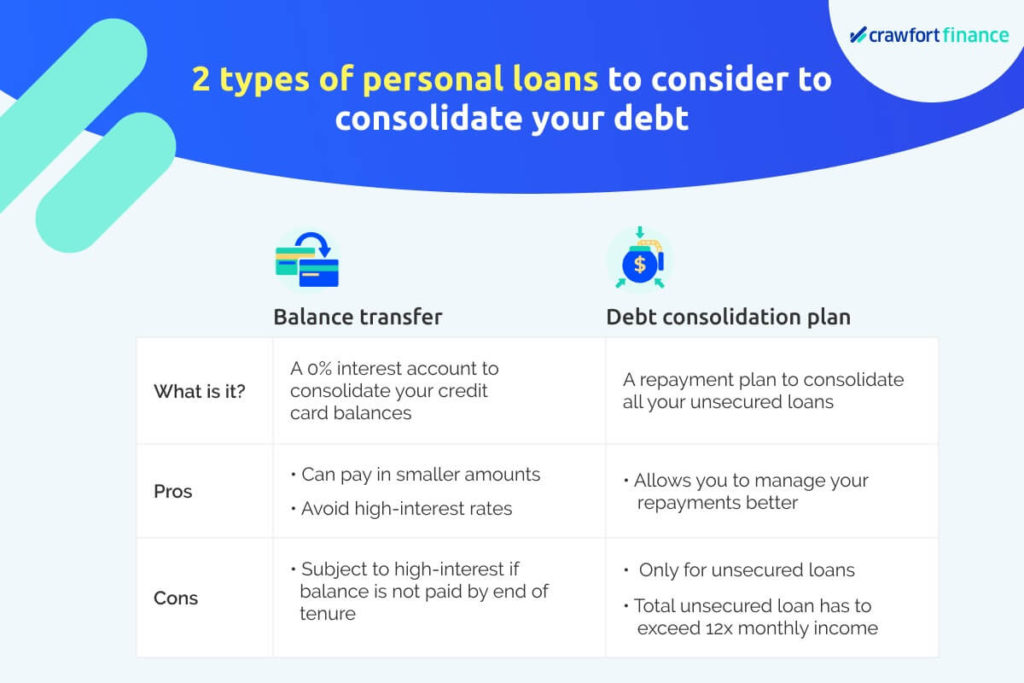

If you’re struggling with debt, here are 2 common personal loan products in Singapore that you can consider to consolidate all your debt. To help you make an informed decision, we’ve prepared some key information on them to help you tackle that snowball!

The 2 Types Of Personal Loans In Singapore For Debt Consolidation

A balance transfer and a debt consolidation plan are two personal loan options you have to consolidate your debt.

There are 2 primary ways to consolidate: a balance transfer and a debt consolidation plan. Both work by consolidating your debt payments into one monthly bill.

1. Balance Transfer

A balance transfer helps you to transfer your unpaid credit card balance to a 0% interest account for a few billing cycles—mostly up to 6 months.

You can choose whether to pay a minimum amount of 1% – 3% of the outstanding amount every month. However, you must pay the remaining amount at the end of the repayment period.

Note that you might also have to pay a processing fee of 1.5% – 5.5%.

There are also banks that offer balance transfers that last 12 months, while some offer balance transfers from 3 months to 18 months.

Besides helping to prevent your credit card bills from snowballing, typical uses for balance transfers include consolidating repayments for emergencies (e.g. car repair expenses and medical bills).

However, if you’re doing a balance transfer, make sure that you can afford the payments. This is because you might have to fork out high interest if you’re unable to repay the full balance amount by the end of the tenure.

For example, let’s say you owe S$6,000 and you take up a 6-month balance transfer. Your minimum payment is 1%, amounting to S$60, which you’ll need to pay for 5 months. On the 6th month, you’ll need to pay the remaining S$5,700. Otherwise, the interest rate can go back to the original—which could be as high as 30%.

Let’s look at the pros and cons of balance transfers that you should keep in mind.

| The Pros And Cons Of Balance Transfers | |

| Pros | Cons |

| A balance transfer allows you to repay smaller amounts throughout the tenure. | You need to repay the full amount by the end of the tenure. Otherwise, the 0% interest rate will go back to the original interest rate—which can be quite high. |

| You can avoid paying high interests rates when you’re unable to pay your balance on time. This gives you more breathing space to repay the debt. | |

Reference: MoneySmart

2. Debt Consolidation Plan

Now that you understand what balance transfers are, let’s look at your next option to consolidate debt: a debt consolidation plan

Debt consolidation is a special type of personal loan in Singapore which offers the option of rolling all unsecured credit facilities (e.g. credit card bills and other types of unsecured loans) into 1 account and with 1 financial institution — for example, a bank.

You can then repay the loan in instalments over a set period of time ranging from 1 to 10 years. Depending on the lender and whether there are any promotional rates, there could be a one-time processing fee.

Learn more about how debt consolidation works here.

However, note that debt consolidation isn’t a silver bullet for your debt problems. Debt consolidation will only work depending on a few factors. This includes your financial situation, whether you stick to a budget, and if you have a plan to keep your debt in check.

Before you go about taking up a debt consolidation plan, here are some pros and cons to take into consideration.

| The Pros And Cons Of Debt Consolidation Plans | |

| Pros | Cons |

| You can secure an interest rate that’s lower than credit cards and unsecured credit lines.

This helps you to lower your overall debt repayments so you can repay it sooner. |

A debt consolidation plan can only be used for unsecured credit, not for secured loans like housing or car loans. |

| A debt consolidation plan allows you to make repayments just once a month, making things more organised for you. | Your total unsecured debt has to be at least 12 times your monthly income.

It is therefore only available for those with higher debt. |

Reference: MoneySmart

Other Alternatives To Help You Clear Your Debt

If neither a debt consolidation plan nor a balance transfer is right for you, there are still alternatives to help you clear your debt.

Here are 3 options that you can consider.

1. Personal Instalment Loan

If your balance transfer tenure has come to an end or if you don’t qualify for a debt consolidation plan, you can explore taking up a personal instalment loan.

This is a lump sum of money that you can use to pay off urgent debts first, followed by paying off the loan over a fixed repayment period.

With Crawfort, you can borrow up to S$3,000 if you earn less than S$20,000 annually, and up to 6 times your monthly income if you’re earning more than S$20,000 annually. In addition, you can choose from one of these repayment schedules: weekly, bi-weekly, payday, and monthly.

2. Negotiate With Your Lender

While you can request for an extension or refinancing plan with your licensed money lender, there may be fees involved.

If you find yourself stuck in a situation where you’re struggling to repay your personal loan in Singapore to a licensed money lender, you can always request an extension or a refinancing plan.

However, note that you might have to incur additional fees for this. Also, make sure you make your request before the next scheduled repayment. This is so you can avoid any charges for late payment.

3. Go For Credit Counselling

Managing one’s finances well isn’t an easy task.

Perhaps not only do you have a job that you’re busy with, you also have a family to run, and a household budget to manage.

Adding debt management to the entire equation can be extremely stressful. With so much to juggle, it can be difficult to know what decisions to make and what steps to take next.

This is where credit counselling can come in useful, where you get professional advice that can help improve your debt situation.

Social services such as Credit Counselling Singapore provide counselling services and can facilitate debt repayment arrangements. What this means is they will work with you to negotiate a more feasible repayment arrangement with your lender.

This can include helping to negotiate better interest rates, lower fees and charges, and a better repayment schedule.

Learn more about how credit counselling can help you manage your debt here.

However, keep in mind that credit counselling will still cost money. In addition, there’s no guarantee that a credit counsellor will be able to negotiate a better deal for you.

Read this article to learn more about what your options are if you can’t repay your debt.