When we’re short on cash, most of us will consider borrowing from friends and family members.

However, if you don’t want to trouble them, how about taking a personal loan instead?

A personal loan is a lump sum of money borrowed from a bank or licensed money lender. You’ll need to pay it back over a fixed period.

There are some criteria you’ll need to meet when applying for a personal loan though.

Are you eligible for a personal loan in Singapore? You’ll find out all you need to know about applying for personal loans here.

When Do I Need A Personal Loan?

Personal loans can relieve your financial burdens, especially in emergencies.

If you’re met with an unfortunate medical emergency, a personal loan can pay off those hefty medical bills.

Personal loans can also help you attain your goals—it can pay off your wedding, education, or even that dream vacation you’ve been planning for years.

In general, personal loans serve various purposes and can be useful in meeting your financial needs!

What Types Of Personal Loans Are Offered In Singapore?

There are 4 types of personal loans in Singapore: personal instalment loan, line of credit, balance transfer, and debt consolidation.

Which type of personal loan should you go for? That depends on what you need.

1. Personal Instalment Loan

Personal instalment loans give you a lump sum of cash at the start, which you’ll pay off through instalments over a set time frame.

It’s the most common type of personal loan in Singapore for situations requiring large sums of money at once, such as weddings or emergencies.

This is also offered by reliable licensed money lenders in Singapore such as Crawfort.

2. Line Of Credit

A line of credit—also known as a credit line or revolving loan—is a pre-approved sum of money, where you can draw any amount of money from it any time you want.

You’ll only need to pay the interest on the amount taken out, and for the duration you borrowed it for (until you’ve repaid the loan).

Due to its high-interest rates, interest for line of credit can go sky-high if you aren’t careful! If you were to take up a line of credit loan, pay it back as quickly as possible. A line of credit also comes with an annual fee. So unless you’re very confident that you can pay back the money immediately, it’s better to skip this option.

3. Debt Consolidation

Debt consolidation is a programme that allows you to take out one loan to pay off other loans. It lets you transfer your outstanding unsecured loans to one place and combines multiple debt balances into a new loan.

This is good for budgeting as it consolidates your debt into a more manageable account with fixed monthly payment.

4. Balance Transfer

A balance transfer is a type of debt consolidation which shifts your debt from one, or many cards, to another with lower interest rate.

This is usually offered by banks, which provide a grace period of 6-12 months, where you won’t be charged any interest.

Learn more about these 4 types of personal loans in Singapore here.

What Are The Eligibility Criteria For A Personal Loan In Singapore?

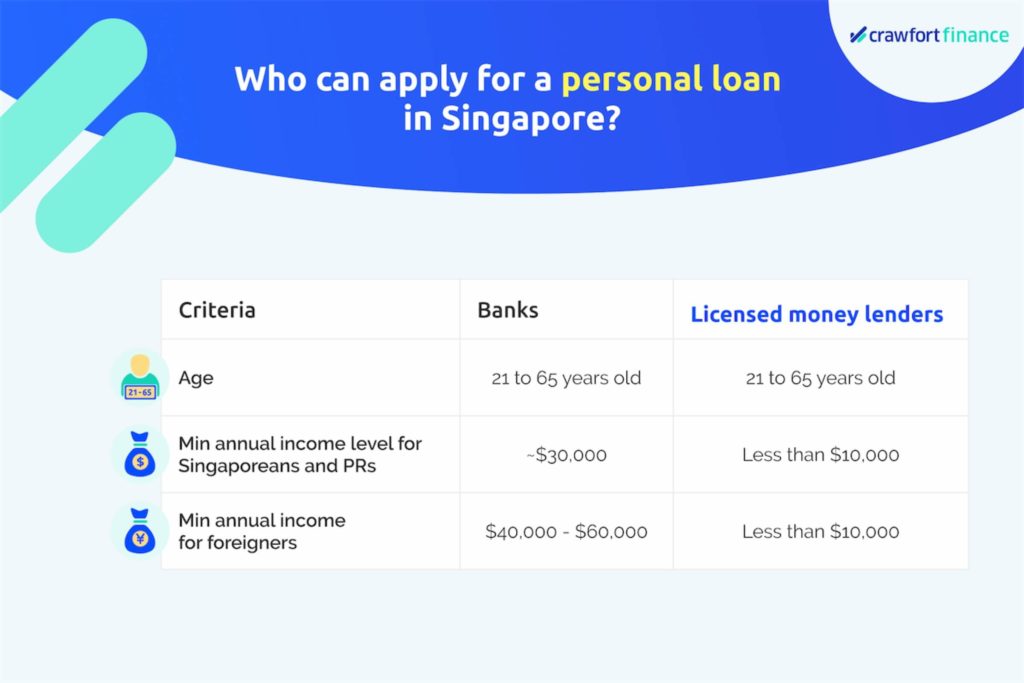

The eligibility criteria for applying for a personal loan in Singapore depends on your citizenship, age, and income level. The specifics also depend on who your lender is.

Singaporeans and PRs have a different set of criteria from foreigners.

But in general, you need to be at least 21 years old to apply for a personal loan.

Bank Loan Eligibility in Singapore: If You’re Borrowing From A Bank

Banks and licensed money lenders also have different criteria. Banks tend to have stricter criteria than licensed money lenders.

For Singaporeans And PRs

Most banks will require you to have an annual income of at least S$30,000 before you can apply for a personal loan. This is regardless of whether you’re a salaried employee or self-employed.

For Foreigners

Depending on the bank, the minimum annual income expected for foreigners is between S$40,000 to S$60,000.

Licensed Money Lender Loan Eligibility in Singapore: If You’re Borrowing From A Lender

Unable to meet the bank’s eligibility criteria?

Banks aren’t your only option! There are other alternatives, such as financial assistance schemes under government agencies that you can look into.

Alternatively, you can consider borrowing from licensed money lenders, which generally have more lenient eligibility criteria.

Learn more about the differences between borrowing from a bank and a licensed moneylender here.

When borrowing from a licensed money lender, be sure to check if it’s in the list of licensed moneylenders from the Ministry of Law (MinLaw) website.

Ensure that you’re given a loan contract to sign too. Before signing it, you should consider all the terms stated in the contract carefully. Make sure that you fully understand the terms of the contract, especially the repayment schedule, interest rates, and any additional fees applicable.

You may also want to read through MinLaw’s FAQs about borrowing from licensed moneylenders before applying for a loan from them.

For Singaporeans And PRs

When borrowing from licensed money lenders, you don’t have to earn at least S$30,000 per year to take out a loan.

If you are a Singaporean or PR earning less than S$20,000 in a year, you can still get a loan of up to S$3,000.

The actual loan amount depends on how much you need and your capability to pay back the loan tenure, which will be based on your creditworthiness.

If you’re earning more than S$20,000 yearly, you can get up to 6 times your monthly income!

Need cash? Apply for a personal loan now with Crawfort!

For Foreigners

Licensed money lenders also offer personal loans for foreigners in Singapore.

If your annual income is less than S$10,000, you can borrow up to S$500.

If your annual income is at least S$10,000 but less than S$20,000, you can take out a loan of up to S$3,000.

However, if you earn more than S$20,000, you can borrow as much as Singaporeans and PRs: up to 6 times your monthly income!

Here’s a table summarising the eligibility criteria.

At A Glance:

| Criteria | Banks | Licensed Money Lenders |

| Singaporeans & PRs | ||

| Age | 21 – 65 years old | |

| Annual income | Min. S$30,000 | If annual income is less than S$20,000: loan amount is up to S$3,000 |

| If annual income is more than S$20,000: loan amount is up to 6 times of monthly income | ||

| Foreigners | ||

| Age | 21 – 65 years old | |

| Annual income | Min. S$40,000 – S$60,000, depending on bank | If annual income is less than S$10,000: loan amount is up to S$500 |

| If annual income is at least S$10,000 and less than S$20,000: loan amount is up to S$3,000 | ||

| If annual income is more than S$20,000: loan amount is up to 6 times of monthly income | ||

What Are The Documents Needed?

Before applying for a personal loan in Singapore, make sure you have these essential documents with you.

You’ll need your IC to verify your citizenship.

You should also prepare your proof of address. This can be documents that state your address, such as your utility bills.

The lender, be it banks or licensed money lenders, will also ask for a proof of income, such as your CPF statement or a payslip.

Advice To Keep In Mind When Applying For A Personal Loan In Singapore

Now that you know the basics of applying for personal loans in Singapore, you can start comparing the different types of personal loans offered by banks and licensed money lenders here.

Ready to start looking into personal loans?

Here are some other things that you should take note of:

Interest Rates

Besides the flat interest rates, you should also take note of the effective interest rates. Effective interest rates (EIR) are a more accurate reflection of the actual cost of borrowing as it takes all the other fees and the loan repayment schedule into consideration.

Loan Tenure

Loan tenure refers to the period for the loan. This affects the amount of interest, repayments, and total cost to be paid.

Processing Fees

The processing fee is a type of administrative fee that is often deducted from the principal. Take note of this as it’s the main hidden cost of personal loans! It increases your cost of borrowing and is often overlooked by borrowers.

If you want to take out a loan from a licensed money lender, consider applying at Crawfort, an established and reliable licensed money lender in Singapore.

Ready to apply for a personal loan? Apply with Crawfort today!