It’s pretty common to take up a car loan and/or a housing loan, especially since it’s costly to own a car and a home in Singapore. But when it comes to taking a personal loan in Singapore, it’s usually perceived as the result of poor financial management.

Depending on the circumstances, taking a personal loan in Singapore may not be as bad as most people think. For instance, if you have a lot of outstanding bills due to unforeseen circumstances, you can take up a personal loan to pay them off.

In general, you can get a personal loan from a bank. But if you have bad credit in Singapore, it’s likely that the bank won’t approve your personal loan application.

There’s still another option for you though; you can get a personal loan from a licensed money lender in Singapore.

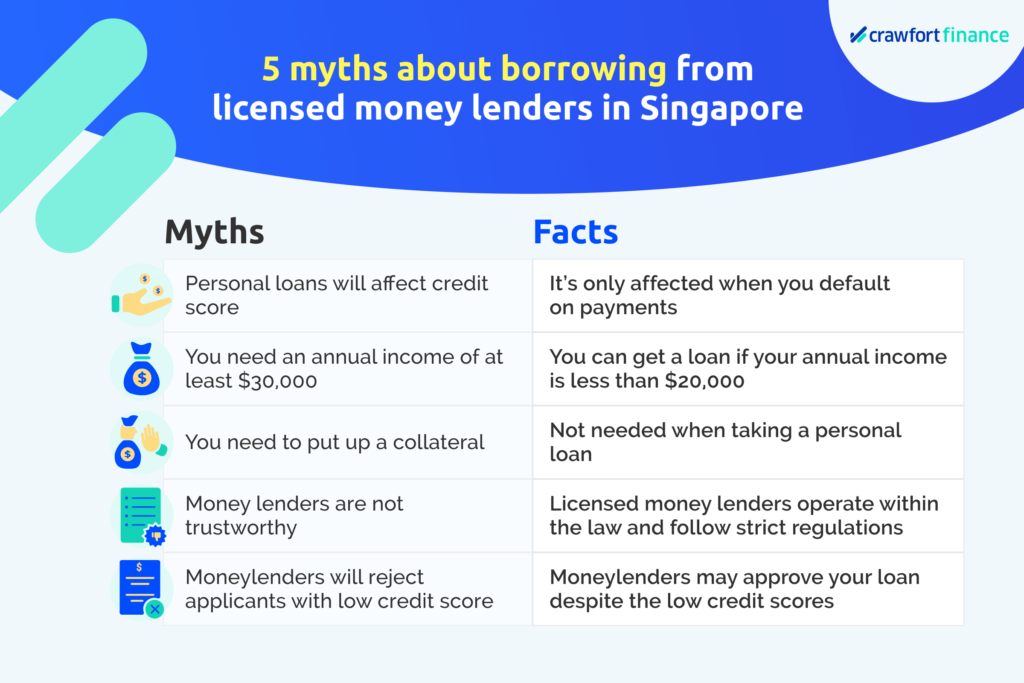

And yes, we understand that there’s a lot of misconceptions about taking a personal loan, let alone taking one from a money lender. So we’re here to debunk these myths in this article.

Myth #1: Taking Personal Loans Will Affect Your Credit Score

The truth is, your credit score won’t be negatively affected if you’re taking a personal loan from a licensed money lender. The credit bureau focuses more on your payment history and income when generating your credit score.

When taking a personal loan, be sure to borrow only what you need and ensure that you have the capacity to pay it back.

If you can’t pay back your repayments on time or even default on them, your credit score will be affected even further. In such a situation, borrowing from other financial institutions will be even harder in the future.

Taking a personal loan can be considered as a financial tool. For instance, personal loans such as a debt consolidation plan can help you manage your loan repayments better. It works by collating all your debt repayments (including multiple credit cards) together into one big loan with just a bank or financial institution.

So this allows you to make one repayment per month for all your consolidated bills, saving you the hassle of paying them separately. Plus, the plan also reduces the risk of you missing your payment deadlines and helps clear your debts faster. Another good thing about the debt consolidation plan is that it also helps you to improve your credit score, which can help to open up more loan options in the future.

Learn more on how you can improve your credit score here.

Myth #2: You Need An Annual Income Of At Least S$30,000 To Get A Personal Loan

To ensure debt repayments, there are certain criteria that you’ll have to meet before you can take up a personal loan. Most banks in Singapore usually require borrowers to have an annual income of at least S$30,000 to apply for a personal loan. This also means that for those who earn less than S$30,000 a year, they may not be able to get a loan from the bank.

But this doesn’t mean that they can’t take a personal loan. Licensed money lenders are open to lending you money even if you earn less than S$30,000 a year.

Do take note, though, that the maximum amount that you can borrow depends on both your annual income level and assessed ability to repay your loan. So the higher your income level, the higher the maximum amount of money that you can borrow.

Here’s a table to illustrate the maximum amount that you can borrow from Crawfort, based on the annual income level.

For Singapore citizens and PRs:

| Annual income | Maximum loan amount you’re eligible for |

| Less than S$10,000 | S$3,000 |

| At least S$10,000 and less than S$20,000 | S$3,000 |

| S$20,000 and above | 6 times of your monthly income |

For foreigners:

| Annual income | Maximum loan amount you’re eligible for |

| Less than S$10,000 | S$500 |

| At least S$10,000 and less than S$20,000 | S$3,000 |

| S$20,000 and above | 6 times of your monthly income |

Myth #3: You Need Collateral To Take Up A Personal Loan

Another thing to note about taking up a personal loan in Singapore is that you won’t have to provide a collateral such as your house. A personal loan is a type of an unsecured loan, which means that it’s not backed by any asset.

Other examples of unsecured loans include the following:

- Credit card loans

- Personal line of credit

- Education loans

- Renovation and furnishing loans

Since the amount for unsecured loans are considered small (as compared to housing loans) and are based on your credit score, a collateral isn’t needed.

This means that if you find yourself unable to pay off your personal loan, the lender won’t be able to take away your assets (such as your house). What they can do, though, is to take legal action against you if no agreements can be reached.

On the other hand, you’ll need to provide a collateral if you’re taking a secured loan, such as a housing loan. Since the amount is quite substantial, you’ll need to put up an asset (like your house) as collateral before the loan can be approved.

Myth #4: Money Lenders Are Not Trustworthy

This is probably one of the most popular myths surrounding money lenders in Singapore.

Some of us associate money lenders with loan sharks or “ah longs” that use red spray paints to write “O$P$” along the corridor of an HDB block.

Licensed money lenders are governed under the Ministry of Law (MinLaw) and are required to abide by strict regulations in order to operate in Singapore.

Here are a few aspects that differentiate a licensed money lender from an illegal one.

Interest Rate

One of the regulations that licensed money lenders need to abide is the interest rate that they can charge borrowers. Under MinLaw’s rules, licensed money lenders can only charge an interest rate of up to 4% per month.

Similarly, the maximum interest rate for late payment is 4% per month and this late payment fee mustn’t exceed S$60. Plus, licensed money lenders can only apply this late interest rate to the amount that’s paid late.

Let’s say you take up a loan of S$5,000. If, for some reason, you miss the deadline to pay the first instalment of S$1,000, the money lender can only charge a late interest based on the S$1,000, and not the remaining S$4,000.

So if you find that a money lender is offering you a personal loan in Singapore with an interest rate of more than 4% per month, it’s likely that they’re a loan shark.

Advertisements

A licensed money lender can only advertise through these 3 channels:

- Business or consumer directories (in print or online media)

- Websites belonging to the licensed money lender

- Advertisements placed within or on the exterior side of the wall, door, shutter, gate, or window of the approved place of business

They’re not allowed to advertise through flyers, emails, SMSes, and other forms of advertisements.

If you’ve been receiving SMSes and WhatsApp messages offering you personal loans, they’re probably from licensed money lenders that are flouting the rules, or illegal money lenders.

Loan Approval Process

Although licensed money lenders promise fast approval, they always go through your loan application and supporting documents before approving your loan.

In addition, they’ll issue a loan contract and go through its terms and conditions with you before you sign it. They’ll also deduct up to 10% of the principal amount for the loan approval fee.

At Crawfort, we deduct the processing fee from your loan. That means that you don’t have to make any payments before your loan is approved.

On the other hand, unlicensed money lenders are more likely to approve your application quickly, without asking for relevant documents like your payslip. They also usually require a large processing fee before they disburse the loan.

Myth #5: Low Credit Score Can Affect Your Loan Approval

Though the loan approval process takes into account your credit, it doesn’t mean that your application will automatically be rejected if you have an outstanding loan and a low credit score.

Depending on your income level, you can still get your personal loan approved in Singapore even with a low credit score. In such a case, your chances of getting an approval will be higher with a licensed money lender, as compared to a bank.

Find out how you can get a personal loan with a bad credit score here.

What your credit score can affect, though, is the amount that you’re allowed to borrow, as well as the accompanying interest rates. If you have a higher credit score, you’re deemed able to pay off your loans on time, and you’ll get to enjoy a higher principal amount and a lower interest rate.

On the other hand, you’re usually subjected to a higher interest rate and limit to how much you can borrow, if you have a low credit score.

If you have a low credit score and are planning to take up a personal loan, you can start by borrowing a small amount first and pay it off on time. This helps to build up and improve your credit score. As your credit score improves, you’ll have more loan options and higher chances of getting larger loan amounts with lower interest rates.

Ultimately, taking up a personal loan from a licensed money lender in Singapore isn’t as bad as it sounds. So before you take up a loan, ensure that the interest rate is below 4% and that it’s within your means.