Life can get pretty unpredictable. Sometimes, you might find yourself in need of quick cash, but your savings is not enough. You may have thought about taking up a loan from the bank, but what if you can’t get across the red tape? The paperwork, the waiting period, and the anxiety of not knowing whether or not your application has been approved… Don’t worry, though. Licensed money lenders in Singapore are a viable alternative that you can consider.

The process of obtaining a loan can be faster and more seamless with a licensed money lender. But with money lenders in Singapore sometimes being associated with “ah longs”, how to differentiate a licensed money lender from an illegal money lender in Singapore? What makes a money lender licensed?

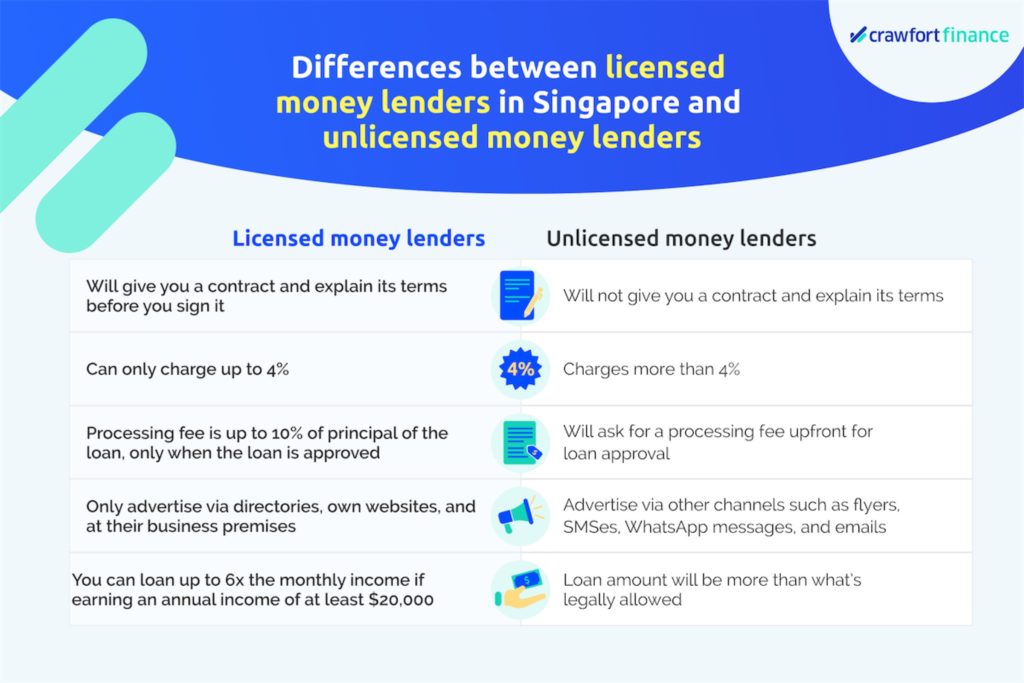

Here are all the differences between a licensed and an unlicensed money lender in Singapore that you need to know.

Differences Between A Licensed And An Unlicensed Money Lender In Singapore

Before you jump into applying for a loan, be sure to consider these 5 factors.

Transparency

Licensed Money Lenders

Transparency, in this case, refers to the unambiguous terms that should be stated in the loan contract offered to you.

Firstly, all licensed money lenders in Singapore are required to explain to you the terms and conditions of the loan in a clear and succinct manner.

They are also required by law to provide you with a loan contract, and state all the loan terms and conditions in it. These include the repayment period, payment method options, the interest rate charged to your loan, and any other details that may affect your loan in the long term.

Unlicensed Money Lenders

On the other hand, unlicensed money lenders often don’t provide you with a contract with these terms.

In addition, be wary of unlicensed money lenders who may send you PDF documents for ongoing loan processes.

These files are often sent by SMS or WhatsApp, supposedly from the Money Authority of Singapore (MAS) or the Ministry of Law (MinLaw) stating that you have to pay a deposit and GST before the loan is approved.

Such documents are part of loan scams. Keep in mind that you’re not required to pay any fees before the loan is approved.

Interest Rate

Licensed Money Lenders

As regulated by MinLaw, licensed money lenders can only charge up to 4% per month for their loans.

On top of this cap, the interest rate charged by a licensed money lender is usually based on its assessment of your creditworthiness.

For late payments, licensed money lenders can only charge a late interest rate of up to 4% per month. This late interest rate is only applicable to the remaining amount that you haven’t paid yet.

For instance, if you take a loan of S$50,000 and have paid S$40,000, the late interest rate is only charged on the remaining S$10,000.

Unlicensed Money Lenders

Conversely, unlicensed money lenders can charge a ridiculously high-interest rate and late interest rate, often well above 4% per month.

Moreover, many of them may choose to include other implicit costs, such as processing fees and other miscellaneous payments.

Fees

Licensed Money Lenders

Licensed money lenders in Singapore are only permitted to impose certain charges and expenses when you take up a personal loan from them.

With effect from 1 October 2015, licensed money lenders can only charge the following fees:

- A fee not exceeding S$60 for each month of late repayment

- A fee not exceeding 10% of the principal of the loan when a loan is granted

- Legal costs ordered by the court for a successful claim by the licensed money lender for the recovery of the loan

One very important thing to note here is that a licensed money lender cannot impose total charges that exceed the principal amount of the loan. The total charges include interest, late interest, upfront administrative fee, and late fees.

For example, if you were to take up a loan of S$50,000, then the interest, monthly S$60 late fees, late interest, and 10% administrative fee cannot go beyond S$50,000.

Unlicensed Money Lenders

Recently, unlicensed money lending in Singapore have been in the spotlight for asking people to pay money even before the loan is granted to them. As part of the scam, they send out SMSes and WhatsApp messages to offer loans to people.

Besides, they instruct people to pay a deposit amount and GST for the loan processing fee. When people decide not to pay or cancel the loan, they would be harassed and told that they’d need to pay to cancel it.

If you encounter this kind of situation, chances are you’re dealing with an illegal money lender in Singapore. Learn more on how you should deal with loan sharks here.

Keep in mind that a licensed money lender in Singapore will not ask for payment before your loan is processed. They can only charge the processing fee after your loan has been granted.

Advertisement

Licensed Money Lenders

As of 1 November 2011, under the advertising rules, licensed money lenders in Singapore are only permitted to advertise through these 3 channels:

- Business or consumer directories (in print or online media)

- Websites belonging to the licensed money lender

- Advertisements placed within or on the exterior (the side of the wall, door, shutter, gate, and window) of the licensed money lender’s business premises

Unlicensed Money Lenders

In the same vein, the advertising rules are your best bet at determining whether or not a money lender is licensed.

If the advertisements come in other channels such as flyers, text messages, emails, and any other media forms, it’s important to note that they’re not permitted under advertising rules. This means that they are either licensed money lenders who have violated the law, or working with unlicensed money lending.

If you ever encounter any of these advertisements, don’t respond to them. Instead, report these advertisements to the Registry of Moneylenders at 1800-2255-529 or via MinLaw’s website.

Loan Amount

Licensed Money Lenders

If you were to opt for a secured loan, you could get a loan of any amount from a licensed money lender.

For unsecured loans in Singapore, such as personal loans, there’s a limit to how much you can borrow. This will depend on your annual income. When borrowing from a licensed money lender, they’ll request for relevant documents such as your payslip.

Here’s a table to illustrate the maximum amount that you can borrow from a licensed money lender in Singapore.

| Annual income | Singapore Citizens and Permanent Residents | Foreigners residing in Singapore |

| Less than S$10,000 | S$3,000 | S$500 |

| S$10,000 – S$20,000 | S$3,000 | S$3,000 |

| S$20,000 and above | 6 times of monthly income | 6 times of monthly income |

Wondering how does a personal loan work? Learn more about it here.

Unlicensed Money Lenders

On the contrary, there’s no limit to how much you can borrow from an unlicensed money lender. This means that you can borrow as much as you want from them, although doing so comes with several caveats. This includes being charged with hidden fees and interest rates way above 4% per month.

Learn more about what you should know about loan sharks here.

In Summary

Essentially, licensed money lenders are governed by MinLaw. If you’re unsure about the status of the money lender you’ve come across, you can refer to the list of licensed money lenders published on MinLaw’s website.

If you suspect that you’re dealing with an unlicensed money lender, you can do the following:

- Call 1800-722-6688 to get scam-related advice.

- Check for related news from www.scamalert.sg to know how to protect your financial and personal information.

- Call the police at 1800-255-0000 to report any illegal activity related to unlicensed money lenders.

Here are some tips to help you protect yourself from unlicensed money lenders:

- Do not disclose any sensitive information such as SingPass, NRIC, and bank account details even when you’re not applying for a loan.

- Do not sign a contract if it lacks important information such as late repayment fees or the type of loan extended to you.

- Do not act as a guarantor for any illegal loans.

- Report any hostile treatment to the authorities.

- If you are in debt or are tight with your finances, consider approaching a social service agency. They can offer you general credit management information, credit counselling, and negotiate a debt repayment plan with creditors.

Thinking of applying for a loan from a licensed money lender? Get started with Crawfort.