Blog

Toa Payoh, one of the first HDB (public housing) areas in Singapore, started in the 1960s to sort out housing for a lot of people. Before it got built up, the place was like a big swamp, which is what “Toa Payoh” means in Hokkien. It was part of Singapore’s rich past because it was […]

Singapore’s northeastern residential district, Hougang, borders Punggol to the north, Upper Serangoon Road to the south, Sungei Serangoon to the east, and Yio Chu Kang to the west. As of 2015, over 51,000 housing units are Hougang New Town, Singapore’s largest public housing estate by land area. This self-sufficient community has several amenities nearby and […]

Ang Mo Kio, situated in the northeastern region of Singapore, derives its name from Hokkien, translating to “red-haired man’s bridge.” As a planning area and residential town, Ang Mo Kio is located approximately 11 km north of the Downtown Core district. Positioned at the south-western corner of the North-East region, it shares borders with Yishun […]

When planning a well-deserved getaway, the excitement of exploring new destinations and creating lasting memories can quickly be overshadowed by the financial considerations of funding your trip. While diligently saving is the ideal approach, it’s not always viable for those with immediate travel plans. Popular financing options in such situations are credit cards and personal […]

Bishan, also known as Bishan New Town or Bishan Town is among the mature residential towns in Singapore. It is an urban planning area that is situated in the central region of Singapore and encompasses a total area of 743 hectares. Due to its size and the fact that it is one of the more […]

Unsecured loans are a popular way to access credit in Singapore, offering flexibility and convenience for a variety of needs. This comprehensive guide provides valuable insights into unsecured loans, covering their definition, types, eligibility criteria, required documents, interest rates, fees, repayment options, associated risks, and tips for securing the best deals. What Is An Unsecured […]

Thinking about borrowing money in Singapore? There are rules in place to help you avoid getting into too much debt. The Moneylenders Credit Bureau (MLCB) is in charge of setting these rules. The MLCB assists the lender in tracking a borrower’s credit history. It acts as a central repository of credit information, wherein you can […]

Life in Singapore can be fast-paced and unpredictable, and there are times when you might find yourself in need of quick financial assistance. This is where a Changi money lender comes into the picture. These loan providers offer various loan options to help you manage unexpected expenses or financial emergencies. Whether you’re a local resident […]

Starting or growing a small business in Singapore often comes down to getting enough capital. For many budding entrepreneurs, figuring out business funding can feel like a real hurdle. While traditional banks offer business loans, their rules can be quite strict, which might push some people to seek other options. One option that might seem […]

If you are experiencing financial difficulty, consider a personal loan. Lucky Plaza in Singapore is well-known for its numerous licensed money lenders, but with such a wide range of options available, how can you be sure you are choosing the right one? This comprehensive guide will provide you with the information necessary to navigate the […]

Tanjong Pagar, one of Singapore’s most vibrant Central Business Districts, is an exciting blend of old and new, rich in heritage while embracing modernity. What began as a simple village settlement, a trading and agricultural hub, and a commercial and residential quarter has transformed into a cosmopolitan district filled with cultural heritage, architectural marvels, and […]

Life has its own set of obstacles and surprises in the bustling town of Clementi, which can be found away in Singapore’s easternmost in the West Region. While family and friends might be the first line of support in times of unexpected emergencies, situations may arise where additional financial assistance becomes imperative. Whether it’s a […]

Debt consolidation loans are increasingly used in Singapore to simplify debt management, often offering lower interest rates. However, many applications are rejected by banks. This blog will review the top and specific reasons for these rejections. Understanding these factors is crucial for individuals and financial advisors to improve application success. We will examine the key […]

As one of Singapore’s premier subzones, Ubi is a hub of economic activity. From the moment you step onto its streets, you are instantly surrounded by a multitude of shops, restaurants, and office buildings. In an area like Ubi, the need for financial support should be as diverse as its residents and workers. That’s where […]

Unexpectedly, you might be looking for access to a 24 hour money lender Singapore or a lender that can provide you with an instant cash loan. A sudden need for cash can arise at any time. Your savings might not be enough to tide you over problems like car repairs or medical bills. Besides, the busy […]

Finding yourself unable to repay a loan can be a stressful experience. Especially when dealing with a licensed money lender in Singapore, the pressure to repay can feel overwhelming. You might be considering a personal loan to cover the debt, but the thought of using your home or car as collateral is daunting. Don’t worry, […]

Bugis, situated in the heart of the Central Business District (CBD) in Singapore, is home to the renowned Bugis Street. Recognised as the largest street shopping destination in Singapore, Bugis Street attracts both locals and tourists alike. In addition to the Bugis Street Market, it is home to two of the most well-known retail centres: […]

Facing financial challenges can seem daunting, but accessing the right support can make a world of difference. In Singapore, particularly in Chinatown, there’s a myriad of lenders offering instant loans to help those who need to fill gaps in their budget. This guide simplifies the process of getting a fast cash loan from a Chinatown […]

In Singapore’s dynamic financial landscape, a cash advance allows individuals to access funds quickly for immediate needs. A cash advance lets you get money quickly, but it’s usually expensive. It often means borrowing cash from your credit card, which adds interest and fees. Moreover, it can include short-term loans from banks and lending apps. This […]

In Singapore’s dynamic property market, homeowners are constantly seeking ways to optimise their financial commitments. Switching your HDB loan to a bank loan can be advantageous, particularly when bank interest rates are lower than the HDB’s 2.6%. By strategically transitioning to a bank loan, homeowners can potentially achieve financial savings, reducing their monthly mortgage payments […]

Credit cards have become an indispensable tool for managing personal finances, offering convenience and the ability to make purchases both online and offline. A key feature of any credit card is its credit limit, which represents the maximum amount you can spend using it. While the initial credit limit assigned by the bank might suffice […]

Navigating the Singapore property market can be complex, especially when financing your dream home. Whether you’re a first-time buyer or a seasoned investor, grasping the Loan-to-Value (LTV) ratio concept is essential. This guide will help you understand everything you need to know about LTV ratios in Singapore’s property market. It will empower you to make […]

For many Singaporeans, managing debt is a crucial aspect of their financial lives. In a bid to assist debtors in attaining financial stability, there have been various steps taken by the government. An example is the Debt Repayment Scheme (DRS), a non-bankruptcy plan for debt repayment. This article describes in detail how the mechanism of […]

When unexpected expenses arise or financial goals come into focus, many people in Singapore explore unsecured credit options like personal loans and line of credit. While both can provide quick access to funds, they have key differences in features, repayment terms, and ideal use cases. In this article, we’ll break down the pros and cons […]

When faced with unexpected financial pressures before your next payday, a quick solution can be found in the form of a payday loan. These short-term loans help individuals cover immediate financial needs until their next paycheck arrives. In Singapore, payday loans are a popular option for those who need quick access to cash to handle […]

In today’s fast-paced world, financial emergencies can arise unexpectedly, requiring quick access to funds. While traditional bank loans often involve lengthy processing, licensed money lenders in Singapore offer a faster alternative. Some even advertise that loan approval only takes minutes to an hour. But can you get a loan approved and receive the money quickly? […]

You’ve probably seen those ads popping up everywhere, claiming they can give loans without any interest, right? Sounds almost too good to be true, doesn’t it? Well, are these zero-interest loans real or not? What’s the actual deal behind these offers, and what catch should you be looking out for when it comes to these […]

When applying for a personal loan in Singapore, a crucial factor that lenders consider is your Total Debt Servicing Ratio (TDSR). Introduced by the Monetary Authority of Singapore (MAS) in 2013, the TDSR framework encourages responsible borrowing and ensures individuals can manage their debt repayments. It achieves this by limiting the amount you can borrow […]

In today’s fast-paced world, financial emergencies can arise unexpectedly. Whether it is a medical emergency, urgent home repairs, or unexpected bills, having immediate access to cash can be crucial. You may ask yourself, “Is a same-day cash loan available?” The answer is yes, particularly when considering licensed money lenders a viable option. In this article, […]

The property market in Singapore poses significant challenges for prospective homeowners. What was once a straightforward journey has become more complex and requires careful consideration. The conventional route of securing a Build-To-Order (BTO) flat now involves extended waiting periods. Previously, these flats required a 5-year wait, but current timeframes have increased to 6-7 years. For […]

Credit cards offer incredible convenience, but it’s important to understand all their features. One feature you might want to avoid is the “cash advance.” Think of it like this: your credit card allows you to borrow money to buy things. A cash advance is similar to taking out a loan, allowing you to receive cash […]

In Singapore, the Housing Development Board (HDB) mandates that all citizens applying for an HDB loan or certain bank loans must first obtain an HDB Loan Eligibility (HLE) letter. This letter serves as proof of eligibility for HDB’s affordable housing loan or other flexible bank loan options, both of which offer significant financial benefits. To […]

Achieving financial freedom can be challenging, and seeking help along the way isn’t just common; it can be a wise decision. A St. James’s Place Asia survey shows the rising tendency of people, especially younger generations, seeking assistance from financial advisers. It reveals that over 91% of Singapore’s youth consider financial advice to be helpful. […]

Offering a diverse selection of foreign currencies and competitive exchange rates, Thomson Plaza Money Changer is the top choice for tourists, travelers, and Singaporeans who need money exchange services. Its convenient location within the Thomson Plaza shopping mall and licensing by the Monetary Authority of Singapore ensure both accessibility and trustworthy service. Knowing how money […]

Taking best personal loans in Singapore from money lender can be something worth considering. This is essential to help you reach your financial goals. Before applying for a low interest personal loan in Singapore, let’s explore more about it. Let’s find out whether or not it can cater to your needs and help you achieve your […]

Personal loans are an alternative for big-ticket purchases or immediate financial emergencies. But before taking up a loan, most of us would be curious as to how much everything would cost in total. One way to find out is to use a personal loan calculator in Singapore to work out the sum. So, what are […]

When we’re short on cash, most of us will consider borrowing from friends and family members. However, if you don’t want to trouble them, how about taking a personal loan instead? A personal loan is a lump sum of money borrowed from a bank or licensed money lender. You’ll need to pay it back over […]

If you’re using a personal loan in Singapore for a big ticket expense, home renovation or to fund some emergencies, it’s probably because your savings is not enough to cover it. And while repaying the loan is usually the last thing on your mind when you take out the loan in the first place, missing […]

Encountering financial difficulties, whether due to unexpected expenses or a job loss, can lead to challenges in paying off credit card bills. This might prompt the question: “What can I do if I’m unable to pay my credit card bill?” Failure to clear credit card bills can result in escalating debt. It’s crucial to understand […]

With the high cost of living in Singapore, handling various debts might be challenging. Debt consolidation can be really challenging especially for individuals with bad credit. However, even with a bad credit score, it is not impossible to consolidate your debts. This guide covers how to do debt consolidation with a bad credit score in […]

Singapore is the most expensive city in the world to live in. This is extremely daunting for the average person who is struggling to make ends meet. With the rising cost of living, unexpected expenses can easily throw off anyone’s budget. When emergencies pop up, needing cash right away can feel super stressful. This is […]

Certain types of loans in Singapore need guarantors since they carry higher risk of default for lenders. For instance, car loans, education loans and business loans, in place of collateral. It can be a requirement when applying for a loan in Singapore. Therefore, before you sign-up to be a guarantor of your friend or your […]

Perhaps it’s a time right now when you require extra financial support for your needs—for an emergency, for a dream vacation for you and your partner, or even for a plan to move forward and venture out of your comfort zone. However good your reasons may be, you may have faced problems having your personal […]

If you’re in a financial jam, you want to get a personal loan as quickly as possible. But what if you don’t have income proof? In this article, we share with you some useful tips on how you can get a personal loan in Singapore without income proof like payslips. But before we dive into […]

Whether it’s buying that dream HDB flat, sending your kid to a good school, or starting your own business, sometimes personal loans are the way to go. But remember, loans aren’t free money, got interest to pay one! Which is why this article on how to calculate interest rates for loans is useful for anyone […]

Proactively monitoring your credit report is a smart and responsible financial habit you should build. This helps you detect fraud and errors, as well as verify the accuracy of the information reported to credit bureaus. With numerous resources that you can take advantage of, it’s possible to get a free Credit Bureau Report in Singapore. […]

Are you a student in Singapore struggling with money? A personal loan can be of great help for things like rent, school expenses, or other costs. But what if you don’t have a job? Can you still get a loan? The good news is that yes, you can get it even without showing income proof. […]

Thinking about borrowing money in Singapore? Loans such as personal loans can help you start a business, buy a car, or finance your dream home renovation. And there are two main options: collateral and non-collateral loans. Collateral loans require you to put up something valuable, like a house or car, as security. If you can’t […]

For many Singaporeans, motorcycles are the most convenient mode of transportation. Not only is it significantly more affordable compared to cars, but it’s also more convenient to maintain. That said, not everyone can pay for a motorcycle upfront – either you still haven’t saved up enough money or just don’t want to touch your savings. […]

Navigating around personal finance is something interesting, especially if you’re curious whether personal loans are subject to taxes. If you’re wondering if personal loans are taxable in Singapore, rest assured – we’ve got you covered. In this article, we are going to discover whether personal loans are subject to taxes. Moreover, let’s find out whether […]

Even after taking a personal loan, unexpected financial events can force you to take another one, especially during this Covid-19 pandemic. And, you may be asking if it is possible to take two personal loans? A personal loan is an unsecured amount of money. It is referred to as unsecured because it does not require collateral. The […]

While many people still go directly to their local bank to seek financial assistance, many people have turned to personal loan brokers for a more customised and efficient approach to borrowing money. This proves that personal loans have gone beyond the confines of traditional banks. In this article, we will discuss personal loan brokers in […]

Whether it’s to buy a first home or pay for education, most of us probably need to take a loan at least once in our life. However, not all loan applications can turn out successful. If you’ve applied for a personal loan in Singapore before but got rejected, it could be due to your credit […]

Your wedding day is probably the most significant milestone as a couple. It’s a momentous and joyous occasion, where family and friends come together to celebrate the love and union between the two of you. How would taking out a personal loan in Singapore come into the picture? Well, every couple dreams of having that […]

If you need extra cash but want the flexibility to use it when you really need it, a line of credit might be helpful. Think of it like a credit card with a ‘tap’. Once approved, you can spend up to that limit. It’s perfect for those home improvement projects you’ve been eyeing or when […]

For many Singaporean homebuyers, the issue of “How much loan can I actually secure from a bank?” arises as an urgent concern. Because it depends on so many different personal details, this question doesn’t have a universally correct response. To properly prepare for a house purchase, you must have a firm grasp of how financial […]

Need a personal loan with bad credit score? It’s tough to get a personal loan in Singapore with bad credit. With a bad credit score, you automatically leave a poor impression on financial institutions, lenders, and banks. The truth is that having bad credit can happen to anyone. A job retrenchment, a wrong choice in […]

Getting a loan? Don’t forget to think about the payback time – this one is very important! You want to pick a loan with a repayment period that works for you. Make sure you’re able to pay it back without stressing yourself out financially. This article will tell you about loan tenure, how it affects […]

In Singapore, borrowers are familiar with various loan options like personal, business, payday, and fast cash loans, commonly offered by banks and licensed money lenders without the need for collateral. While many have navigated auto or HDB loans successfully, the distinction between recourse and non-recourse loans might not be as clear. These often-ignored terms have […]

Need some quick cash? Feeling tempted by those flashy ads promising “easy money, no hassle“? Hold on right there! Before you jump into the arms of a loan shark (or their slick online equivalent), let’s break down the real deal on personal loans with “guaranteed instant approval” in Singapore. Spoiler alert: It is not always […]

Picture yourself in this situation: after taking a personal loan for an urgent need or a significant life event, you’re now eyeing your dream home. Because of this, you find yourself facing a common problem experienced by many Singaporeans – balancing dreams and financial commitments. As you weigh your options, understanding the intricacies of managing […]

Situated in the eastern part of Singapore, Tampines stands as the third-largest new town, a product of strategic urban planning. Once a landscape dominated by forests, swamps, rubber plantations, and sand quarries, the town’s name, Tampines, originates from the indigenous Ironwood trees, also known as “tempinis,” which once flourished in abundance in the area. Aligned […]

If you’re facing some kind of financial difficulty, getting a personal loan in Singapore could help improve your situation. Whether you choose to borrow from a bank or a licensed money lender in Singapore, you have a decision to make: you’ll need to decide whether to take out a secured personal loan in Singapore or […]

Bedok is known for its incredible community, but it is also a place where unexpected financial needs can arise. Be it for an unforeseen medical expense, a sudden business requirement, or a personal emergency, the traditional banking route’s complex procedures and strict criteria may not be enough for the average Bedok resident. This is where […]

Sometimes, unexpected events are bound to happen where you need money right away. These emergency situations are unavoidable. If you are in Singapore’s retail heart, which is Orchard Road, you might be looking for some quick options where you can borrow money. However, borrowing from a friend or a relative may not always be a […]

Yishun, formerly known as Nee Soon, is one of the best spots in Singapore that offers a perfect mix of tradition and modernity. But it isn’t just a place – it’s a community. And just like any community, especially one that is part of the most expensive city in the world, financial hurdles are part […]

Have you ever felt trapped in a debt cycle? If so, you already know that it can take its toll on your life and relationships. Borrowing can be an addiction that causes harm not just to your finances, but also to your well-being. If you need a way to break free from this compulsive behaviour […]

As your family grows, you might plan to buy a bigger property and sell your existing home. As you are still in the process of selling your property, your funds may not be enough. Your savings might not be enough to cover the expenses of buying a new home. Moreover, borrowing from family members or […]

Jurong East is a small yet vibrant neighbourhood in Singapore. This is among the places in Singapore that boast attractions like the renowned Jurong Bird Park, home to over 3500 birds, and the Singapore Discovery Centre. Delight in family-centric amenities, such as KidSTOP at the Science Centre, a dedicated play zone offering various activities and […]

Ever heard the term “instalment loan” thrown around but wondered what it means? Don’t worry, you are not alone. Borrowing can definitely be overwhelming at times, especially when you encounter unfamiliar terms and concepts. However, understanding the ins and outs of instalment loans is essential for anyone seeking financial assistance in Singapore. To better understand […]

Sometimes, we may face financial emergencies or require quick cash for unexpected expenses. In these challenging times, borrowing from a moneylender can be an ideal way to get the needed funds. However, before taking out a loan, it is vital to understand the interest rates and fees that private moneylenders can charge in Singapore. In […]

When it comes to loan applications, your credit score or credit rating significantly influences the likelihood of approval. Major loan providers such as banks consider it a primary factor in assessing your eligibility for a loan. A favourable credit score suggests a high likelihood of loan approval, whereas a low credit score makes it challenging […]

There could be a situation where you urgently need cash to tide over an unforeseen situation. One solution to consider is applying for a short-term loan in Singapore. In this article, we’re going to share with you all you need to know about short-term loans in Singapore. What’s A Short-Term Loan? A short-term loan usually […]

The past few months have been difficult for many people in various industries. Most businesses, especially in the service industry, have been badly affected by the COVID-19 social distancing measures. Taking a personal loan in Singapore is one option to get through this tough time. Ever since the outbreak began, less people have been going […]

The priciest thing you can buy in Singapore is probably your home. Even if you don’t mind a rugged aesthetic, minimalistic, or industrial look, basic renovation is still necessary for installation of electrical endpoints, tilework, paintwork, and so on. If you’ve done the maths, you’ll realise that renovations can cost an arm and leg. However, […]

Whether you need a helping hand to achieve a resolution you’ve set for the year, or you’re in urgent need of money, getting a personal loan in Singapore from a licensed moneylender may come in handy. But before you apply for a personal loan in Singapore, here are some important things that you need to […]

It is tough sometimes when we land ourselves in unexpected situations that require immediate financial assistance, such as medical emergencies or investment opportunities. At times like this, taking out a personal loan in Singapore could be a viable option to ease your financial burden. A personal loan is a type of unsecured loan that does […]

Despite the government’s provision of a tuition fee grant, the cost of tuition continues to rise annually. In fact the average annual education inflation rate in Singapore was about 2.86% for a 20-year period (2002-2022). Moreover, it was reported that the school fees will increase from 2024 to 2026 for PR and international students. So, […]

Peer-to-peer lending or P2P lending is a part of financial innovation that originated in the UK in 2005. It has become an investment and lending platform that has reached major financial markets worldwide, and Singapore is no stranger to P2P lending. It has adopted this FinTech tool for borrowing and lending money. In this guide, […]

Considering a home renovation project this year, but falling short on your savings? You might consider getting a home renovation loan. Without sacrificing your objectives, this type of loan is designed to assist you in funding your home improvements. But, how do home renovation loans in Singapore work, and what should you take into account? […]

Life is full of challenges and unfortunately facing sudden financial trouble is part of it. You may be facing a sudden medical emergency, car repair or the need to replace a broken appliance which may require quick cash to cover these emergencies. In these unexpected events having an emergency payday loan from a direct lender […]

Whether you want to increase your property value or simply enhance the aesthetics of your house, you need a home renovation. However, loan renovations can be costly and you may not be able to do up your dream house should you lack funds. Now, the good news is that you have alternative options to help […]

When your bills and emergency expenses pile up, it can be hard to resist the temptation of payday loans. Although these loans can be a helpful remedy for tough times, they also have the potential to trap you in overwhelming debt. Thankfully, there are tons of ways to help you get back on track financially. […]

Credit cards have a lot of benefits. Not only do they boost your spending power, but they’re also very convenient since you don’t need to keep drawing and carrying cash. However, for the convenience they offer, you run the risk of incurring high interest and accumulating debt quickly. What should you do when you find […]

When we need cash, some of us consider taking personal loans to get through the tough period. Unfortunately, it can be difficult to get a personal loan in Singapore when you’re unemployed. Don’t worry, though. There are alternatives to personal loans in Singapore that you can take up, even if you’re unemployed. This article is […]

One major factor that makes a huge difference in whether you get approved for a personal loan is your total debt servicing ratio. If you haven’t heard this concept before, it might seem complicated, but don’t let it scare you. To put it simply, your TDSR is just a way to figure out if you […]

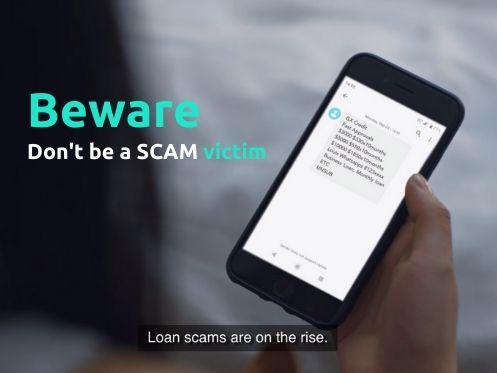

As of 14 October, the police warned the public about the return of loan scams involving fake emails from banks and government agencies in Singapore. Between 1 September and 4 October 2021, there were 17 victims losing a total of over $130,000. While the Police have suggested ways to help combat scams, it is important […]

Just collected the keys to your new house? Buying a house is most likely the largest purchase in your life. After getting the keys, you’ll want to renovate it to turn it into your dream home. In this article, we look at renovation costs, what affects it, as well as financing options like a renovation […]

Are you planning your next dream vacation as more countries now allow tourists for the first time in two years since the start of the COVID-19 pandemic? Did you then realise that you may need extra cash as your travel funds are insufficient? If so, you’ve come to the right place! Read on. You will learn […]

It’s never a nice feeling being rejected for anything, especially when it comes to a personal loan application. If you’ve ever been in this position before, you will know how discouraging this can be. So, why are personal loan applications in Singapore rejected? And what can you do to avoid it happening to you? Keep […]

Personal loans and credit cards are two popular credit options in Singapore. For instance, if you are short of cash to pay your monthly bills, getting a personal loan in Singapore or paying through your credit card can be a viable option. Both provide easy access to money when in need but getting a personal loan can […]

Have you been thinking of taking a break for this coming holiday season? Are you also considering rewarding yourself or your family with a memorable holiday gift? As the country eases the travel restrictions especially to fully vaccinated Singaporean residents, traveling to your dream destinations is now possible. Regardless of the plans you have for […]

Taking a personal loan in Singapore from licensed moneylenders can help you manage your unexpected expenses, such as medical bills. Moreover, it can help you in fulfilling your life goals. While it can make a huge difference in managing your financial situation when it matters most, it is not a permanent solution. Although you are free to use […]

In the time of a pandemic (like now), you need to be prepared for emergency expenses. However, if you are someone who does not have savings or is hesitant to borrow money from friends or family, then you could be in trouble when an emergency arises. But, don’t worry, getting a personal loan in Singapore to tide […]

Having sufficient money can help you achieve your New Year’s goals. However, if you don’t have enough cash, taking a personal loan in Singapore is something worth considering. With a personal loan, you can get a relatively substantial sum of fast cash, and this is useful if you already have big goals and plans for New Year. […]

If you are currently in need of quick cash for emergencies or holiday spending, you might consider taking a personal loan either from a licensed moneylender or bank. You might wonder how long it takes to get a personal loan from these credit facilities. How fast does it take to get your loan application approved with a licensed […]

According to the latest Finder’s survey, nearly 1 in 3 (that’s 32% or 928,000 Singaporeans) have taken out a personal loan in the past 12 months. Some of the key reasons why people are taking out personal loans in Singapore include, covering daily expenses, helping out a friend or family, and financing a mortgage. But […]

You might be looking for a personal loan to help you cover some financial needs. But with the overwhelming amount of loan products and choices out there, how do you find the best personal loan in Singapore? Financial institutions in Singapore offer loan discounts and promotions periodically; it’s important that you learn how to compare […]

Life is always unpredictable, and there may be times when you need to take up a loan to tide through unexpected financial difficulties. It could be medical emergencies, debts, bills to pay, or simply urgent cash needs. And if you’re unemployed, getting a personal loan in Singapore can be difficult. In Singapore, banks and financial […]

RED ALERT: crawforts.com is a SCAM site posing as us. Apart from using a web URL that bears close resemblance to ours, this website also displayed our previous brand logo and company information that are stolen from us. Please be informed that this site has no relations to us and are likely to be operated […]

Maybe you’ve already been sitting on the idea of taking the plunge into the world of short-term courses. Whether it’s learning a new design software or discovering a different industry, short-term courses are all the rage for both working professionals and students alike to upgrade their skills. But maybe you’re hesitant because of many factors, […]

Loan scams are on the rise now. Please stay vigilant and beware of scammers who may approach you with attractive loan offers through calls, SMSes or any other media forms. Don’t be impulsive and fall into their traps. Learn to differentiate between a licensed and unlicensed money lender in Singapore. Crawfort Finance will only advertise […]

Besides being symbolic of financial independence and adulting, owning a credit card is a great way to earn rewards and cashback on your spending as long as you pay your bills dutifully every month. But what if you’re unable to pay your bills on time? With sky-high interest rates and a few late payment fees, […]

Have you been toying with the idea of taking a good break for a while? And when we mean a break, we mean a good, quality break that’s going to give you a good reset. Maybe it’s been something on your mind for a while now but you haven’t gotten around to it because it’s […]

According to Robert Kiyosaki, a successful businessman and author of Rich Dad Poor Dad, continuous learning is the key to getting rich. If you want to be successful in life, you need to have the right attitude, the right mentality, and seek continuous learning. Even after graduating, you should continue to upgrade your skills, which […]

Your wedding day is undoubtedly one of the most important days of your life. If you’ve been saving diligently after meeting “the one”, kudos for planning in advance! However, it may be the case that your savings still aren’t enough to cover the costs of your dream wedding. To help you along on your journey, […]

It’s always good when we receive a heads up before something happens, so that we can prepare for it. But that doesn’t happen all the time. You can never predict when something unexpected crops up, and when you need extra cash urgently. In such times, a personal loan can be a viable option. Types Of […]

We’re often told to continuously upgrade our skills because we need to stay relevant in times of changing needs. And one way to do that is through taking up courses. Plus, doing so can be helpful when we choose to switch careers. But taking up courses in Singapore can be quite expensive. For instance, a […]

Have you ever found yourself stuck against a wall financially? When you have so many bills to pay, then suddenly, you or someone you know gets into an accident or gets sick. You are then overwhelmed with bills and the debt you need to pay, and the money you’ve saved or earned just isn’t enough […]

Personal loans can seem like a mystery. What are they? When should you take them? How do you go about applying for personal loans in Singapore? A personal loan is a lump sum of money borrowed from a bank or licensed money lender, which you have to pay back in instalments (fixed payments) over a […]

It’s pretty common to take up a car loan and/or a housing loan, especially since it’s costly to own a car and a home in Singapore. But when it comes to taking a personal loan in Singapore, it’s usually perceived as the result of poor financial management. Depending on the circumstances, taking a personal loan […]

Our Media Coverage and Achievements

Since 2011

8 Minutes is All You Need

Approved by