Blog

Taking best personal loans in Singapore from money lender can be something worth considering. This is essential to help you reach your financial goals. Before applying for a low interest personal loan in Singapore, let’s explore more about it. Let’s find out whether or not it can cater to your needs and help you achieve your […]

Taking best personal loans in Singapore from money lender can be something worth considering. This is essential to help you reach your financial goals. Before applying for a low interest personal loan in Singapore, let’s explore more about it. Let’s find out whether or not it can cater to your needs and help you achieve your […]

Personal loans are an alternative for big-ticket purchases or immediate financial emergencies. But before taking up a loan, most of us would be curious as to how much everything would cost in total. One way to find out is to use a personal loan calculator in Singapore to work out the sum. So, what are […]

When we’re short on cash, most of us will consider borrowing from friends and family members. However, if you don’t want to trouble them, how about taking a personal loan instead? A personal loan is a lump sum of money borrowed from a bank or licensed money lender. You’ll need to pay it back over […]

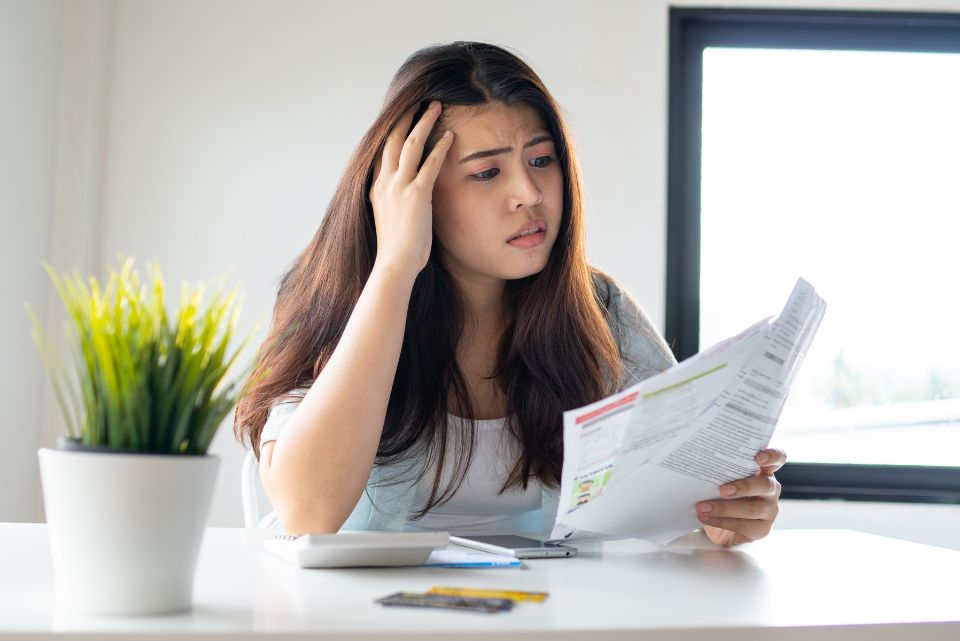

If you’re using a personal loan in Singapore for a big ticket expense, home renovation or to fund some emergencies, it’s probably because your savings is not enough to cover it. And while repaying the loan is usually the last thing on your mind when you take out the loan in the first place, missing […]

Encountering financial difficulties, whether due to unexpected expenses or a job loss, can lead to challenges in paying off credit card bills. This might prompt the question: “What can I do if I’m unable to pay my credit card bill?” Failure to clear credit card bills can result in escalating debt. It’s crucial to understand […]

With the high cost of living in Singapore, handling various debts might be challenging. Debt consolidation can be really challenging especially for individuals with bad credit. However, even with a bad credit score, it is not impossible to consolidate your debts. This guide covers how to do debt consolidation with a bad credit score in […]

Singapore is the most expensive city in the world to live in. This is extremely daunting for the average person who is struggling to make ends meet. With the rising cost of living, unexpected expenses can easily throw off anyone’s budget. When emergencies pop up, needing cash right away can feel super stressful. This is […]

Certain types of loans in Singapore need guarantors since they carry higher risk of default for lenders. For instance, car loans, education loans and business loans, in place of collateral. It can be a requirement when applying for a loan in Singapore. Therefore, before you sign-up to be a guarantor of your friend or your […]

Perhaps it’s a time right now when you require extra financial support for your needs—for an emergency, for a dream vacation for you and your partner, or even for a plan to move forward and venture out of your comfort zone. However good your reasons may be, you may have faced problems having your personal […]

If you’re in a financial jam, you want to get a personal loan as quickly as possible. But what if you don’t have income proof? In this article, we share with you some useful tips on how you can get a personal loan in Singapore without income proof like payslips. But before we dive into […]

Whether it’s buying that dream HDB flat, sending your kid to a good school, or starting your own business, sometimes personal loans are the way to go. But remember, loans aren’t free money, got interest to pay one! Which is why this article on how to calculate interest rates for loans is useful for anyone […]

Proactively monitoring your credit report is a smart and responsible financial habit you should build. This helps you detect fraud and errors, as well as verify the accuracy of the information reported to credit bureaus. With numerous resources that you can take advantage of, it’s possible to get a free Credit Bureau Report in Singapore. […]

Our Media Coverage and Achievements

Since 2011

8 Minutes is All You Need

Approved by