Blog

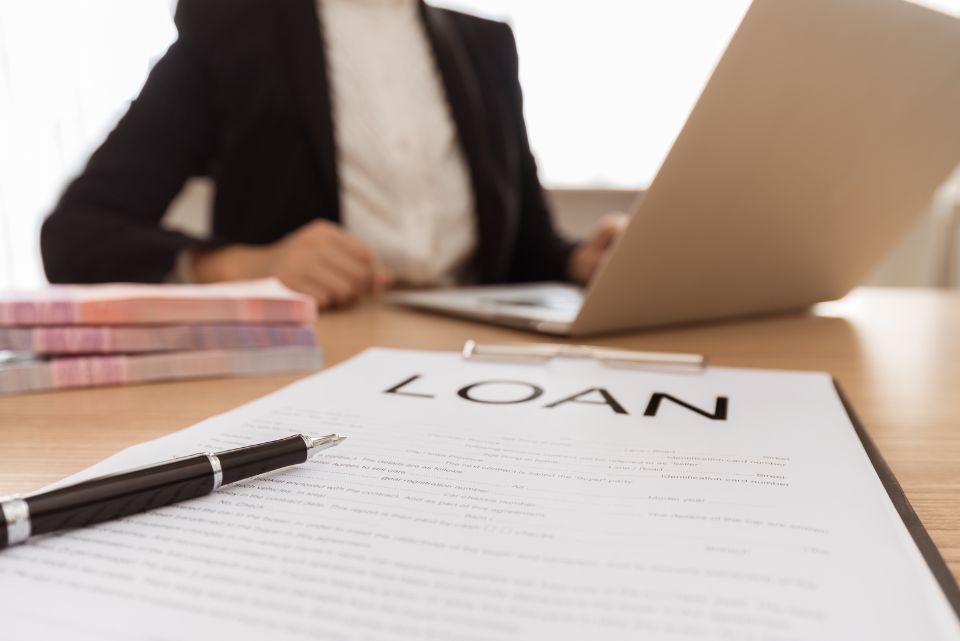

Are you short of funds and planning to borrow from the best licensed money lender in Singapore? But before that, you must first understand the things to consider before borrowing from the best licensed moneylenders in Singapore or credit companies. Paying off bills and expenses without any assistance can be really challenging, especially when you’re […]

Singapore’s a fantastic city, but let’s be honest – it can be tough on your wallet! Even with a decent paycheck, those living costs add up fast. But don’t worry, this post is all about changing that. We’ve got a bunch of tips to help you save, even if you’re not rolling in cash. You […]

If you need extra cash but want the flexibility to use it when you really need it, a line of credit might be helpful. Think of it like a credit card with a ‘tap’. Once approved, you can spend up to that limit. It’s perfect for those home improvement projects you’ve been eyeing or when […]

For many Singaporean homebuyers, the issue of “How much loan can I actually secure from a bank?” arises as an urgent concern. Because it depends on so many different personal details, this question doesn’t have a universally correct response. To properly prepare for a house purchase, you must have a firm grasp of how financial […]

Need a personal loan with bad credit score? It’s tough to get a personal loan in Singapore with bad credit. With a bad credit score, you automatically leave a poor impression on financial institutions, lenders, and banks. The truth is that having bad credit can happen to anyone. A job retrenchment, a wrong choice in […]

Getting a loan? Don’t forget to think about the payback time – this one is very important! You want to pick a loan with a repayment period that works for you. Make sure you’re able to pay it back without stressing yourself out financially. This article will tell you about loan tenure, how it affects […]

In Singapore, borrowers are familiar with various loan options like personal, business, payday, and fast cash loans, commonly offered by banks and licensed money lenders without the need for collateral. While many have navigated auto or HDB loans successfully, the distinction between recourse and non-recourse loans might not be as clear. These often-ignored terms have […]

Need some quick cash? Feeling tempted by those flashy ads promising “easy money, no hassle“? Hold on right there! Before you jump into the arms of a loan shark (or their slick online equivalent), let’s break down the real deal on personal loans with “guaranteed instant approval” in Singapore. Spoiler alert: It is not always […]

Picture yourself in this situation: after taking a personal loan for an urgent need or a significant life event, you’re now eyeing your dream home. Because of this, you find yourself facing a common problem experienced by many Singaporeans – balancing dreams and financial commitments. As you weigh your options, understanding the intricacies of managing […]

Situated in the eastern part of Singapore, Tampines stands as the third-largest new town, a product of strategic urban planning. Once a landscape dominated by forests, swamps, rubber plantations, and sand quarries, the town’s name, Tampines, originates from the indigenous Ironwood trees, also known as “tempinis,” which once flourished in abundance in the area. Aligned […]

If you’re facing some kind of financial difficulty, getting a personal loan in Singapore could help improve your situation. Whether you choose to borrow from a bank or a licensed money lender in Singapore, you have a decision to make: you’ll need to decide whether to take out a secured personal loan in Singapore or […]

With the lure of credit cards and their rewards (think airmiles, cashback, free luggage), many Singaporeans end up with large credit card debt. Swiping the card is so easy and convenient, that many fall into the endless debt trap. If you find yourself struggling to make timely credit card and personal loan repayments in Singapore, […]

Bedok is known for its incredible community, but it is also a place where unexpected financial needs can arise. Be it for an unforeseen medical expense, a sudden business requirement, or a personal emergency, the traditional banking route’s complex procedures and strict criteria may not be enough for the average Bedok resident. This is where […]

Our Media Coverage and Achievements

Since 2011

8 Minutes is All You Need

Approved by