Best Licensed Moneylenders in Singapore: Guide to Borrowing Loans from Legal Lenders

Are you short of funds and planning to borrow from the best licensed money lender in Singapore? But before that, you must first understand the

Every couple dreams of an unforgettable wedding. It’s a once-in-a-lifetime event, but savings might not always be enough to cover those dreams. A wedding loan could be the solution to relieve financial strain and cover key expenses such as the bridal package, banquet, rings, dowry, and honeymoon. Now, couples can say ‘I do’ with financial ease.

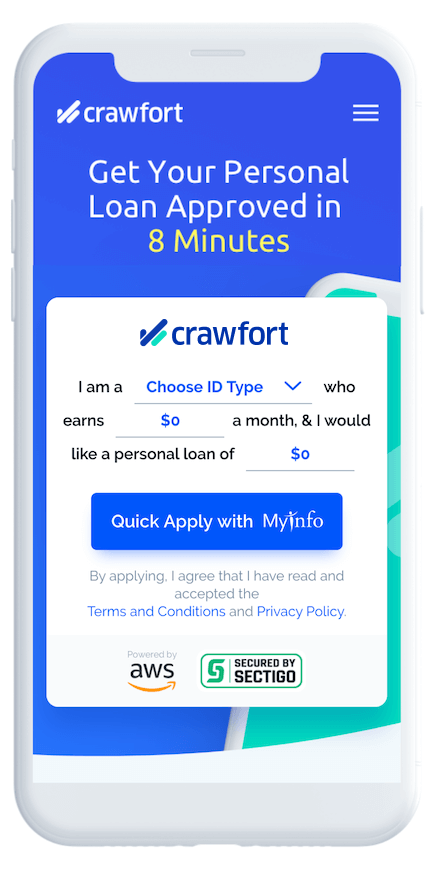

At Crawfort, it only takes 8 minutes to get your loan approved.

Our plans are tailored to your needs. So you can worry less and enjoy more. These are our commitments to you.

As one of the most trusted personal loan providers in Singapore, we have disbursed more than 200,000 loans since 2011. We have won an award from Singapore’s Prestige Brand Awards 2019, and will continue to provide high-quality service and care for our customers.

Every step of our loan process is tailored to your convenience. We have digitalised everything from application to credit scoring to payment. Repayments are even simpler. Just pay through any SAM/AXS machines and you’re good to go.

Privacy protection is our top priority. Our servers are encrypted with state-of-the-art technology. You’ll never have to worry about us divulging your information to anyone.

A wedding loan can be the key to unlocking the celebration you’ve always envisioned, providing both financial flexibility and peace of mind.

Here’s how it can help:

Whether it’s securing the perfect venue, booking a talented photographer to capture every moment, or hiring a professional wedding planner to coordinate the details, a wedding loan ensures you have the funds to turn your dream wedding into reality.

Unlike some loans that require you to put up your assets as security, wedding loans are typically unsecured. This means you can borrow with confidence, knowing you won’t risk losing your home or other valuable possessions.

With streamlined online applications and quick approval times, getting a wedding loan is simple and convenient. You can focus on the joy of planning your wedding instead of worrying about complex financial hurdles.

By borrowing responsibly and making timely payments on your wedding loan, you can actually improve your credit score. A higher credit score opens doors to better interest rates on future loans, mortgages, and even credit cards.

Every couple’s financial situation is unique. Wedding loans offer flexible repayment options, allowing you to choose a plan that fits your budget and income. This means you can manage your finances after the wedding without feeling overwhelmed.

Timely payments are crucial in the wedding planning process. With a wedding loan, you can access the funds you need quickly, ensuring your vendors and suppliers are paid on time.

A wedding loan, commonly provided by banks, financial institutions, and licensed moneylenders in Singapore, covers various wedding expenses such as engagement rings, banquet fees, attire, services like stylists and makeup artists, invitations, videography, rentals, parties, dowries, honeymoons, and related costs. This financial support helps couples achieve their dream wedding, ensuring they can cover the entire event cost even with tight finances.

Wedding loans can help make your special day a reality, but it’s important to borrow wisely. Here are the key factors to consider when taking out a wedding loan:

Budget & Cost:

List every anticipated wedding expense, from the venue and catering to attire and invitations. Account for unexpected expenses like alterations, vendor tips, or last-minute additions. If possible, save for a down payment to reduce the loan amount and potentially lower interest rates.

Eligibility Requirements:

Lenders typically have income requirements. Check their guidelines to see if you qualify. Your credit history plays a crucial role; a good credit score increases your chances of approval and may lead to better interest rates. Lenders prefer borrowers with a consistent income history.

Interest Rates & Fees:

Shop around and compare interest rates from different lenders. Even small differences can add up over time. Be aware of processing fees, late repayment fees, or other charges that may be added to the loan.

Financial Status:

Calculate your debt-to-income ratio (DTI) to see how much of your income is already allocated to debt payments. Lenders consider this when assessing your ability to repay. Also, assess your savings to determine how much you can contribute to wedding expenses upfront. Consider your long-term financial goals and how taking on a loan may impact them, such as saving for a house, retirement, or other objectives.

Repayment Options and Loan Tenure:

Choose a loan with monthly payments that comfortably fit your budget. Check if there are penalties for early loan repayment. Some lenders offer flexibility, while others may charge fees.

Speed of Approval:

If you need funds quickly, look for lenders known for fast approvals. However, prioritize favorable loan terms (interest rates, fees) over quick approval to ensure financial benefits in the long run.

You can receive your wedding loan quickly because Crawfort has streamlined the loan application process and uses cutting-edge technology. It only takes 8 minutes to approve your loan. In fact, you can receive your loan on the same day you apply, as long as it’s approved. This means you can get fast cash to cover your wedding expenses.

Applying for a wedding loan nowadays is easy. Most lenders have online lending platforms where you can apply. In fact, at Crawfort, you can complete the online application in a matter of minutes. Our tech-enabled algorithm will approve your wedding loan in as little as 8 minutes.

Ready for a hassle-free loan experience? With Crawfort, you’re just a few simple steps away from getting the financial support you need. Here’s what you’ll need to be eligible:

Taking a personal loan in Singapore can help you to achieve your goals. It is also an ideal solution for your immediate need for cash. But, if this is your first time to take a personal loan, it is essential to get guided.

Are you short of funds and planning to borrow from the best licensed money lender in Singapore? But before that, you must first understand the

Toa Payoh, one of the first HDB (public housing) areas in Singapore, started in the 1960s to sort out housing for a lot of people.

Singapore’s northeastern residential district, Hougang, borders Punggol to the north, Upper Serangoon Road to the south, Sungei Serangoon to the east, and Yio Chu Kang

Ang Mo Kio, situated in the northeastern region of Singapore, derives its name from Hokkien, translating to “red-haired man’s bridge.” As a planning area and

When planning a well-deserved getaway, the excitement of exploring new destinations and creating lasting memories can quickly be overshadowed by the financial considerations of funding

The cost of living is high in Singapore. There are times when we inevitably run into money problems and need cash to tide over difficult