Best Licensed Moneylenders in Singapore: Guide to Borrowing Loans from Legal Lenders

Are you short of funds and planning to borrow from the best licensed money lender in Singapore? But before that, you must first understand the

If unforeseen medical bills, such as hospitalisation, emergency care, surgeries, medications, or any health-related expenses, are straining your budget, you may be able to pay for these expenses with the assistance of an unsecured medical loan.

A medical loan can help you cover these surprising bills. Crawfort only takes 8 minutes to approve your loan, so you can get the cash you need quickly.

Our plans are tailored to your needs. So you can worry less and enjoy more. These are our commitments to you.

As one of the most trusted personal loan providers in Singapore, we have disbursed more than 200,000 loans since 2011. We have won an award from Singapore’s Prestige Brand Awards 2019, and will continue to provide high-quality service and care for our customers.

Every step of our loan process is tailored to your convenience. We have digitalised everything from application to credit scoring to payment. Repayments are even simpler. Just pay through any SAM/AXS machines and you’re good to go.

Privacy protection is our top priority. Our servers are encrypted with state-of-the-art technology. You’ll never have to worry about us divulging your information to anyone.

Are you running out of funds and dealing with unforeseen medical bills? Securing a loan for medical expenses can be beneficial. With this unsecured loan, you may easily get the money you need for any unexpected medical bills.

Here are the top reasons why you may need to get a medical loan:

Medical emergencies may arise at any time without warning. You may have to pay a huge medical bill for treatments, hospital stays, and medications as a result. On the other hand, with a medical loan, you don’t have to worry, as this is designed to cover unexpected medical bills.

Major surgeries, extended medical treatments, or specialised therapies are actually expensive. Your savings may be completely depleted as a result. Furthermore, your emergency funds might not be sufficient. However, with a medical loan you can effectively create a budget without depleting your savings.

In contrast to certain other loan types, medical loans are often granted quickly, guaranteeing that you will have access to money when you need it most. In emergency situations where time is important, this is essential. In fact, at Crawfort, it just takes 8 minutes to approve this loan.

In general, medical loans are unsecured, which means you can apply for them without pledging any assets as a collateral. This increases their accessibility to a wider range of borrowers.

Most medical loans include a flexible repayment period, so you can select a schedule that works with your budget. The repayment schedule may be adjusted to fit your current financial situation.

If you keep using your funds to cover your medical costs, you can run into financial difficulties. On the other hand, you may keep saving for your future goals by using a medical loan.

Medical loans in Singapore are unsecured personal loans often provided by licensed money lenders to provide funds for paying off any medical-related bills such as medical emergencies, surgeries, hospital visits, treatments, specialised therapies, and medications.

Singapore’s medical expenses are not cheap and continue to rise annually. According to a study, experts anticipate a 10.7% increase in medical expenses this year.

There are scenarios where some medical costs are not often covered by insurance, and your savings are also not enough to pay off unexpected bills. Therefore, taking out a medical loan is an effective way to cover these surprising bills.

You can apply with ease because collateral is not required for these unsecured loans. It also has a flexible repayment time, longer loan tenures and affordable interest rates, so you may simply pay off the bills and prepare for future repayments by creating a budget plan.

Medical loan providers include banks, financial institutions, licensed moneylenders, and medical providers. Banks, on the other hand, have stringent requirements and you may need to have at least S$20,000 salary annually. Because of this, borrowers often obtain a medical loan from trusted lenders.

Legal moneylenders have easier requirements and can quickly approve your medical loan, so you can immediately access the funds when you need them the most. Moreover, depending on your financial situation and ability to repay, the best licensed money lenders can offer loans up to six times your monthly pay helping you to cover larger medical expenses.

Medical loans, like other loan types, won’t immediately have a negative impact on your credit. On the other hand, your credit score may suffer if you make late repayments or take excessive debts. In addition, your credit score can temporarily drop if your lender runs a credit check while processing your application

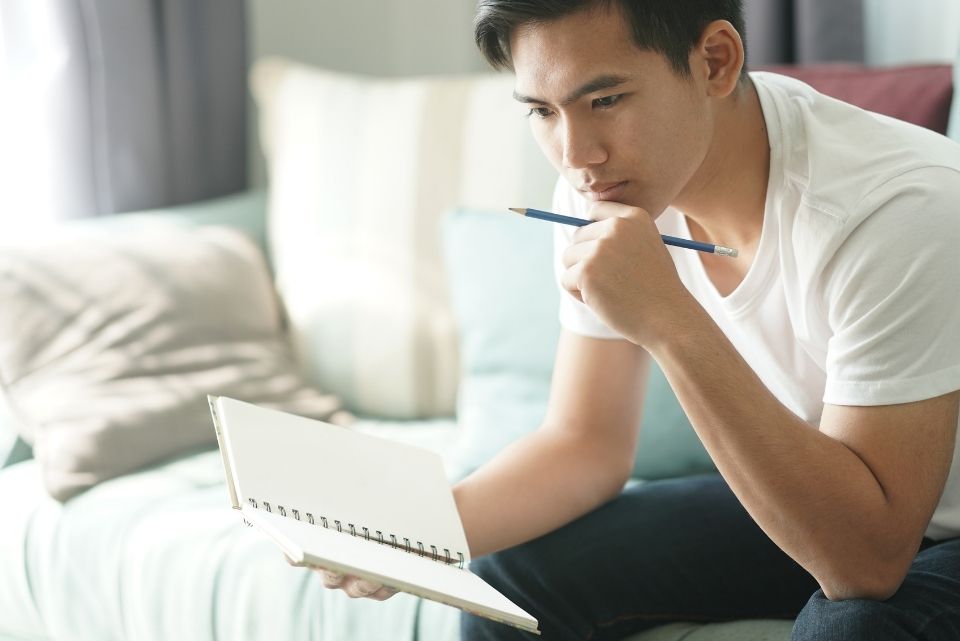

In times of financial challenges especially when facing unforeseen hospital bills, medical loans may seem like the only way to pay for these expenses.

2. Loan Amount and Repayment Period

Just borrow what you need, and try to stay away from taking on too much debt as this could strain your finances.

Additionally, choose a period of repayment that works within your financial capacity. Remember that a shorter repayment period could mean lower overall interest rates but larger monthly payments. Longer repayment terms, however, may lead to cheaper monthly payments but higher interest rates altogether.

3. Eligibility Criteria

A minimum yearly salary is typically required by lenders to make sure you can repay the loan. Furthermore, documentation of regular employment may be required by certain lenders. Consequently, to determine if you are eligible for this kind of loan, it is imperative that you review the eligibility requirements of your chosen lender.

Medical loans are offered by licensed money lenders to borrowers who meet certain requirements:

If you meet all of these conditions, you should be able to apply for a medical loan from a legal lender.

See a financial advisor if you’re not sure which medical loan option is best for you. They can assist you in evaluating your financial status and provide the best loan option for your requirements.

Nowadays, it’s simple to apply for a medical loan. You can apply for a medical loan online at the majority of lenders’ lending sites. In fact, the Crawfort online loan application takes only a few minutes to complete. There is no minimum monthly income required, and its tech-enabled algorithm can approve your medical bill loan in as little as 8 minutes.

Taking a personal loan in Singapore can help you to achieve your goals. It is also an ideal solution for your immediate need for cash. But, if this is your first time to take a personal loan, it is essential to get guided.

Are you short of funds and planning to borrow from the best licensed money lender in Singapore? But before that, you must first understand the

Today, you can take advantage of various enticing credit card deals that offer benefits like bonus miles and up to 10% cashback. These deals can

In Singapore’s dynamic financial landscape, a cash advance allows individuals to access funds quickly for immediate needs. A cash advance lets you get money quickly,

In Singapore’s dynamic property market, homeowners are constantly seeking ways to optimise their financial commitments. Switching your HDB loan to a bank loan can be

Credit cards have become an indispensable tool for managing personal finances, offering convenience and the ability to make purchases both online and offline. A key

Starting or growing a small business in Singapore often comes down to getting enough capital. For many budding entrepreneurs, figuring out business funding can feel