Best Licensed Moneylenders in Singapore: Guide to Borrowing Loans from Legal Lenders

Are you short of funds and planning to borrow from the best licensed money lender in Singapore? But before that, you must first understand the

Are you a Grab, Gojek or Taxi driver in Singapore facing tight cash flow? Unexpected repairs, rising fuel costs, or personal emergencies can put a strain on your finances. A taxi loan can be your lifeline, offering quick access to funds to cover urgent expenses and keep your business running smoothly.

At Crawfort, it only takes 8 minutes to approve your taxi loan.

Our plans are tailored to your needs. So you can worry less and enjoy more. These are our commitments to you.

As one of the most trusted personal loan providers in Singapore, we have disbursed more than 200,000 loans since 2011. We have won an award from Singapore’s Prestige Brand Awards 2019, and will continue to provide high-quality service and care for our customers.

Every step of our loan process is tailored to your convenience. We have digitalised everything from application to credit scoring to payment. Repayments are even simpler. Just pay through any SAM/AXS machines and you’re good to go.

Privacy protection is our top priority. Our servers are encrypted with state-of-the-art technology. You’ll never have to worry about us divulging your information to anyone.

The taxi industry in Singapore, is experiencing rapid growth, but it also faces several challenges. With high down payments for cars and rising Certificate of Entitlement (COE) prices, owning a car for taxi driving can be difficult. Additionally, the ongoing expenses of car maintenance can strain drivers’ finances.

Fortunately, Grab and Gojek driver loans are specifically designed to address these financial needs. These loans offer tailored solutions to help drivers overcome various challenges:

Loans can be used to purchase a newer, more fuel-efficient vehicle, or to cover essential maintenance and repairs on an existing car. This can lead to better fuel economy, lower maintenance costs, and a more comfortable ride for passengers, which can ultimately lead to increased earnings.

Unexpected expenses like accidents, medical bills, or family emergencies can put a strain on finances. A loan can provide quick access to cash to cover these unforeseen costs and avoid falling behind on other bills.

For drivers who rent their vehicles, these loans can help manage the ongoing rental costs and ensure a steady income stream, even when facing unexpected expenses or during periods of lower demand.

If a driver has multiple high-interest debts, a loan can be used to consolidate them into a single, lower-interest payment. This can make managing finances easier and reduce the overall amount of interest paid.

Ride-hailing demand can fluctuate seasonally or due to external factors. During slower periods, a loan can help supplement income and cover basic expenses until business picks up again.

While not directly related to the job, a loan can also be used for personal needs like education, home improvements, or debt repayment, which can improve overall financial well-being and reduce stress.

A Grab/Gojek/taxi driver loan in Singapore is a personal loan often offered by financial institutions, ride-hailing companies and licensed money lenders designed to help ride-hailing and taxi drivers manage work-related expenses like car repairs, maintenance, and financial emergencies.

To be eligible for this loan, you may need to meet the following basic requirements:

You may need to the following documents:

When considering a Grab Taxi or Gojek Driver Taxi Loan, here are some key factors to take into account:

To apply for a Grab, Gojek or Taxi Driver Loan at Crawfort make sure that you meet the basic eligibility requirements. If you have met the requirements, you can now proceed to online application. Then, wait for the approval confirmation. At Crawfort, it only takes 8 minutes to approve your application.

Make sure to gather necessary documents, including your NRIC, proof of income, and any other relevant financial information.

Once approved, you need to head down to the office for verification and the disbursement process.

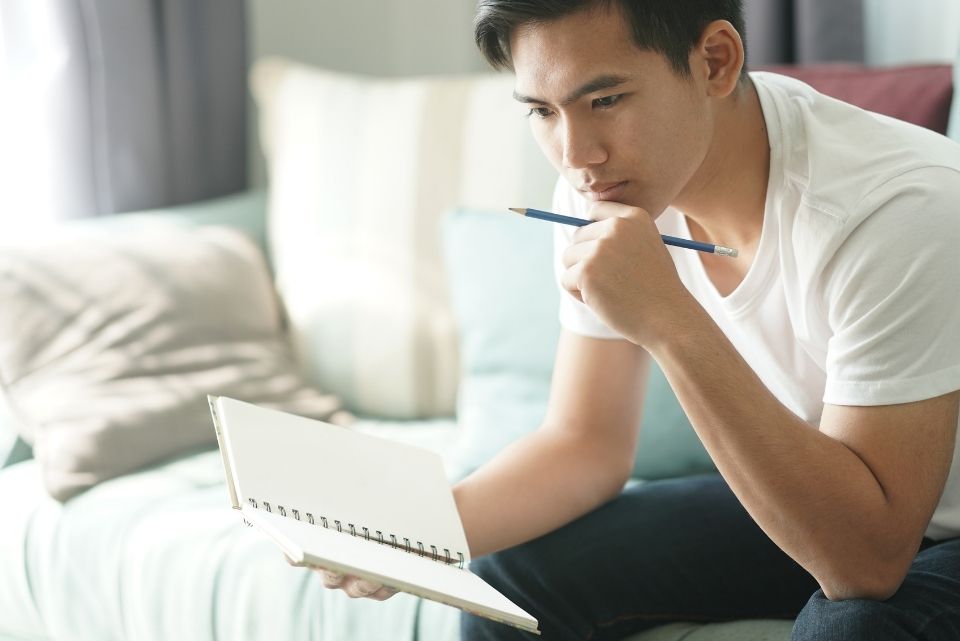

Taking a personal loan in Singapore can help you to achieve your goals. It is also an ideal solution for your immediate need for cash. But, if this is your first time to take a personal loan, it is essential to get guided.

Are you short of funds and planning to borrow from the best licensed money lender in Singapore? But before that, you must first understand the

Today, you can take advantage of various enticing credit card deals that offer benefits like bonus miles and up to 10% cashback. These deals can

In Singapore’s dynamic financial landscape, a cash advance allows individuals to access funds quickly for immediate needs. A cash advance lets you get money quickly,

In Singapore’s dynamic property market, homeowners are constantly seeking ways to optimise their financial commitments. Switching your HDB loan to a bank loan can be

Credit cards have become an indispensable tool for managing personal finances, offering convenience and the ability to make purchases both online and offline. A key

Starting or growing a small business in Singapore often comes down to getting enough capital. For many budding entrepreneurs, figuring out business funding can feel